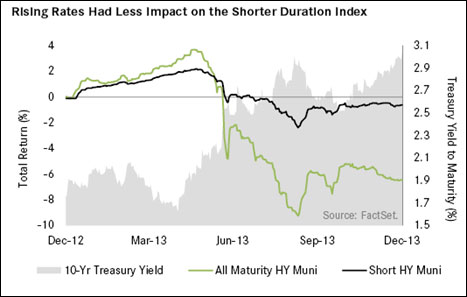

This past Tuesday we launched SHYD, Market Vectors® Short High-Yield Municipal Index ETF. SHYD seeks to track an index that only includes bonds with 1-10 years until maturity. The focus on this maturity range has generally meant lower duration — or sensitivity to changes in interest rates — and yields competitive with those of an all-maturity high yield municipal bond index. Less rate sensitivity has generally meant less of a negative impact on total return during periods of rising interest rates.

Index performance is not illustrative of Fund performance. Fund performance current to the most recent month end is available by visiting marketvectorsetfs.com. Past performance does not guarantee future results.

SHYD offers:

- High Yield, Short Duration Focus

The Index comprises highest yielding municipal bonds with maturities of 1-10 years. This potentially provides lower sensitivity to interest rates than all-maturity high yield municipal bond funds. - Enhanced Liquidity

The Index includes 25% BBB investment-grade exposure for added liquidity. - Diverse Sector Exposure and Low Default Rates

The Index covers a wide range of muni sectors and securities with historically low default rates.1