In the great inspirational movie The Shawshank Redemption, Tim Robbins plays Andy Dufresne, a man facing seemingly impossible odds: Wrongly imprisoned for life, former banker Andy has only the books in the paltry prison library, his love of carving stone chess pieces, and his imagination to sustain him.

Though the situation seems dire, Andy maintains his focus on his long-term goal of escape and holds on to hope even when circumstances test his mettle. He chips away at the stone wall of his prison cell using a rock hammer, turning his insurmountable obstacle into a trail of dust over the course of several years and eventually returning to life on the other side.

As both a movie buff and an investor, I find myself thinking of what parallels could be drawn between The Shawshank Redemption and the Federal Reserve’s anticipated normalization of monetary policy over the next several years. To be sure, the scope of quantitative easing (QE) in some of the world’s largest economies and the ultralow interest rates globally are unprecedented. The graphs below show the current balance sheet of the Fed.* Since 2008, the Fed has expanded its assets through various QE programs to combat the effects of the global financial crisis and the ensuing weakness in the labor market and inflation metrics.

For some time, I and others at Vanguard have voiced concerns about some of the market “side effects” of QE. In particular, investors’ reach for yield, spurred by suppressed Treasury bond yields, into other segments of the global financial markets (e.g., high-yield bonds, REITs, and emerging markets stocks) that for a time appeared “frothy.” Perhaps the recent marked underperformance of those investments justifies our past concerns. More important for you and me, the Federal Reserve shares reservations about the marginal costs of QE—thus the increased focus on tapering.

What are the two big outstanding questions? First, what may the Fed’s exit timetable look like? And, second, how may it affect the market and the economy?

Tapering ≠ tightening

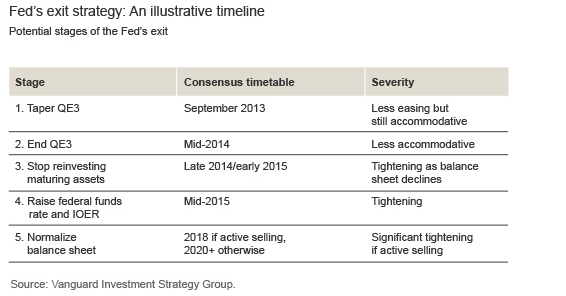

As I have said before, tapering does not equal tightening. It’s easy to lose sight of the fact that the Fed’s “escape” could be a very long and drawn-out process, much like Andy Dufresne’s plan of painstakingly chipping his prison walls into dust. The framework for the Fed’s exit strategy, which was first presented in the minutes of the June 2011 meeting of its Open Market Committee, stretches across several years, beginning with the tapering of asset purchases, which precedes an eventual tightening of monetary policy. Tapering will consist of a progressive step-down in the amount of assets the Fed is purchasing each month, currently $45 billion in Treasury securities and $40 billion in MBS.

I believe the table below highlights a reasonable timeline of the potential stages of the Fed’s exit strategy. If there is one certainty in this plan, it’s that it will change based on the state of the U.S. economy, although the general order of the stages will likely remain the same. My confidence level in the dates drops exponentially as you move down the chart. Indeed, the Fed may never actually sell securities on its balance sheet but, rather, allow them to gradually mature, while using other tools, such as the ability to pay interest on excess reserves (IOER) and reverse repos, to manage the level of reserves in the banking system.