Plus, should any political instability impact the stock market later in the year, mid-caps can tolerate more market volatility than their smaller and larger counterparts. Recently, large-cap funds such as the SPDR S&P 500 (NYSEArca: SPY) have seen outflows in the billions. Still, SPY has managed to gain 5.3% in 2013, signaling investor confidence in U.S. equities. [ETF Chart of the Day: Mid-Cap Stocks]

Long term, mid-caps haven been solid performers as they have outperformed both small-and large-cap stocks over a five-year period and year-to-date, reports Zacks. The iShares Core S&P Mid-Cap ETF (NYSEArca: IJH) has returned about 4% this year. [Mid-Cap ETFs Off and Running in 2013]

Other mid-cap ETFs:

iShares Core S&P Mid-Cap ETF

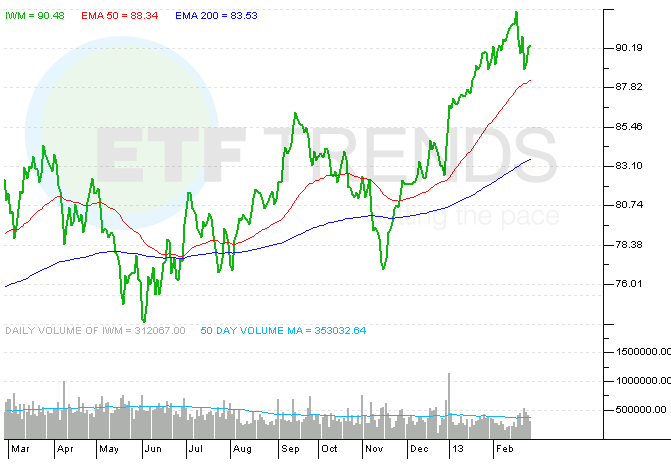

Small-cap stocks are able to capture the activity of a local economy while spreading out exposure, according to Zacks, but they are able to expose investors to more growth than large- or mid-caps. Small-caps are known for higher levels of volatility due to their size and the fact that the companies are relatively unstable in relation to larger-caps companies. The iShares Russell 2000 Index Fund (NYSEArca: IWM) has returned about 3% this year and has outperformed SPY by 100 bps in 2013. [Small and Micro-Cap ETFs]

iShares Russell 2000 Index Fund