Treasury yields have been steadily declining over the past 30 years. Over the next 12 to 24 months, however, yields could begin to rise and investors are about to experience an investment environment that their parents and grandparents can only relate to.

After dropping to historic lows on the so-called risk-off environment during the heightened market volatility witnessed last year, U.S. Treasury yields are beginning to inch higher. As investors become more comfortable with the equities market and take on greater allocations in riskier assets, the long end of the Treasury curve could continue to move upward. Reflecting this trend, Treasury related ETFs have dipped below their key technical support levels.

In this special report on yields we aim to help investors understand that while rising rates may not be one of the most pressing topics de jour, it is still a subject to closely monitor.

- The U.S. Treasuries market has provided investors with a safe and liquid investment, but investors have piled into the asset class, pushing up prices and dampening yields.

- While interest rates will remain at near-zero for now, individuals should be aware of the effects higher yields will play on a fixed-income portfolio. Investors should begin to formulate a strategy to help mitigate the potential hit.

- Lastly, investors relying on the reliability of the money market may soon find themselves scrambling as regulators take a crack at the status quo.

U.S. Treasuries

Treasury ETFs provide the average retail investor with the opportunity to gain a similar investment return to owning the actual Treasury bonds. As such, Treasury ETF investors may enjoy the safe-haven status of the Treasuries market.

For example, during the Eurozone financial debt crisis and downgrade of the U.S. debt last year, Treasury ETFs outperformed as global investors sought the relative safety of the highly liquid U.S. Treasuries market. It is interesting to note that many financial experts largely expected the U.S. large deficit to erode confidence in U.S. assets, especially after the S&P downgraded the country’s sovereign debt from it sterling triple-A status, but investors still fell right back to the comfort of the Treasuries market during any signs of trouble.

Consequently, the flight to quality has pushed yields on long-term Treasuries dated over 20+ years to their mid-2% levels and the benchmark 10-year notes to near all-time lows of around 1.7%. In contrast, 20-year Treasuries over the past decade have provided average yields of 4.7% and 10-year Treasuries showed average yields of 3.7%.

Treasury prices are inversely related to yields. If Treasuries attract greater investment interest, their prices will increase and yields will be pressured. If investors begin to dump Treasuries, prices will fall and yields will begin to rise. We are currently in a three decade long Treasuries market rally as yields on the benchmark 10-year Treasury notes have fallen from over 14% in the early 1980s to below 2% in 2011. Most market observers have argued that Treasury yields are nearing their bottom and the bubble in Treasuries prices will soon burst. [Short ETFs for Rising Interest Rates]

More recently, the positive market sentiment has lifted investors’ risk profile and sent Treasury investors packing. Treasury prices are falling on the stock markets forward momentum as investors realize that the U.S. economy hasn’t fallen back into a double-dip recession and after the Federal Reserve announced its optimistic economic outlook. Additionally, the financial sector – a major cause for concern in 2008 and the main contributor to the push into safe-haven Treasuries – passed the recent string of stress tests on its large banks. The U.S. economy is adding more jobs, the housing market is slowly improving and consumers are shopping again. So far, all the signs point to optimism.

Investors are beginning to realize that stocks are trading at very cheap valuations, compared to fixed-income assets. Corporations are reporting stronger earnings but their price-to-earnings still remain close to historic averages. Consequently, yields on the benchmark 10-year notes have expanded to recent highs of 2.3% and yields on 30-year Treasuries have hit 3.4%.

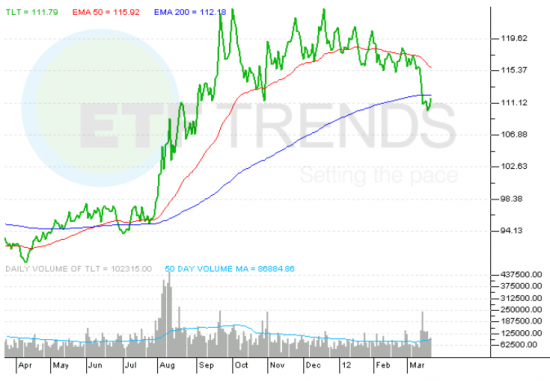

Treasury ETFs, like the iShares Barclays 20 Year Treasury Bond Fund ETF (NYSEArca: TLT) and iShares Barclays 7-10 Year Treasury Bond Fund ETF (NYSEArca: IEF), have fallen below their 50-day exponential moving averages and are now testing their 200-day EMA support level.

iShares Barclays 7-10 Year Treasury Bond Fund ETF

iShares Barclays 20 Year Treasury Bond Fund ETF

Interest Rates

The Federal Fund rate can be manipulated as the Federal Reserve supplies more short-term securities in the open market. As the Fed sells the short-term securities, borrowers exchange U.S. dollars for the securities, diminishing the overall money in circulation. Consequently, the less money sloshing around the market raises the short-term interest rates since less credit for borrowers will raise the costs to borrow. As the low-end of the Treasury curve is raised, yields on other Treasuries will begin to follow suit.

Currently, the Federal Reserve is committed to holding interest rates at near zero until at least late 2014. The Fed will maintain its low rates as the U.S. economy slowly recovers. However, if the U.S. economic data disappoints the market, the Federal Reserve may opt to launch a new bond-buying program, or Quantitative Easing III, to stimulate lagging growth. In which case, Treasury prices could shot up and yields will fall back down to historic lows, again.

Currently, the Federal Reserve is committed to holding interest rates at near zero until at least late 2014. The Fed will maintain its low rates as the U.S. economy slowly recovers. However, if the U.S. economic data disappoints the market, the Federal Reserve may opt to launch a new bond-buying program, or Quantitative Easing III, to stimulate lagging growth. In which case, Treasury prices could shot up and yields will fall back down to historic lows, again.