Triangle patterns suggest indecision in markets.

SPDR S&P 500 ETF (NYSEArca: SPY) was fractionally higher Wednesday afternoon in choppy trading.

“The pause for breath is allowing oversold conditions to correct,” the analyst wrote in a newsletter. He recommended investors favor defensive stock sectors. [Defensive Sector ETFs Still Leading]

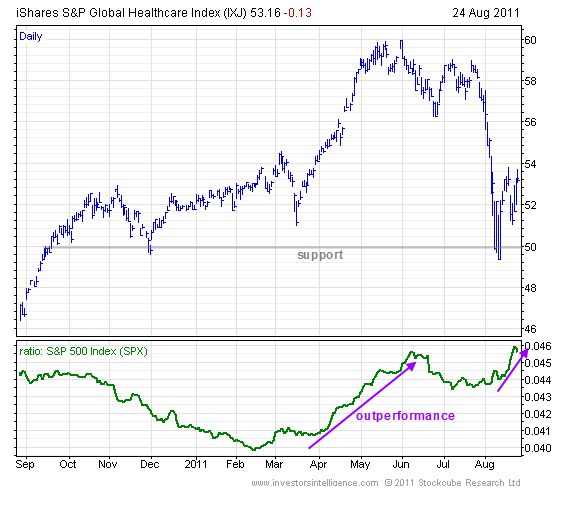

“The iShares S&P Global Healthcare Index (NYSEArca: IXJ) has outperformed since February. That relative trend against the S&P 500 broke out to new twelve month highs at the start of this week,” Coe said. “The price has decent support across $50 [a share]but more importantly outperformance is expected to continue in these uncertain times. The fund has a yield of 2.1%.”