Exchange traded funds tracking the S&P 500 were set to rise more than 1% at Tuesday’s open following economic reports on retail sales and producer prices.

In this options expiration week, traders are looking for an oversold bounce in U.S. stocks near the S&P 500’s channel support.

The S&P 500 had a “fleeting move” beneath Friday’s low on Monday but it is “very encouraging that the index failed to extend that breakdown attempt,” said Tarquin Coe, technical analyst at Investors Intelligence.

The S&P 500 needs to regain a foothold above 1281, and such a move would be bullish “as it would confirm that Friday’s break lower was a head fake,” the analyst said. “Should that happen, trading would then likely resume within the gently rising channel and as such result in an eventual new recovery high. We continue to ride out the weakness.”

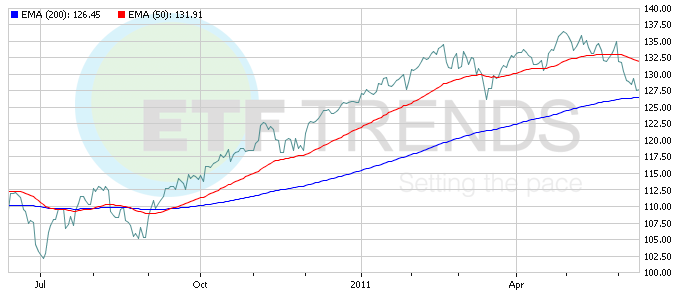

SPDR S&P 500 ETF (NYSEArca: SPY)

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.