Today is the day the markets and exchange traded funds (ETFs) have been holding their breath for: hotly contested midterm elections and a Federal Reserve meeting, after which the central bank is anticipated to unveil its quantitative easing plans.

The Federal Reserve has kicked off a two-day meeting this morning, sending bond ETFs higher and the dollar lower. The bank is nearly unanimously expected to announce an asset purchase program aimed at goading the economy further. PIMCO 25+ Year Zero Coupon U.S. Treasury (NYSEArca: ZROZ) is the top-moving bond ETF this morning, up 2.2% so far. [Know What to Expect from Your Bond ETF Portfolio.]

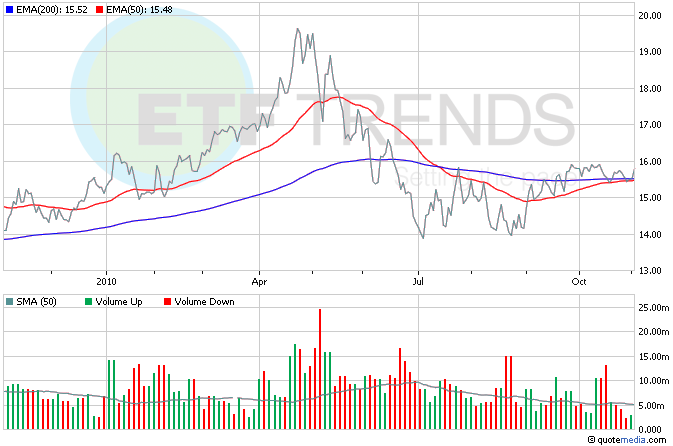

Health care ETFs are in focus this morning following Pfizer’s (NYSE: PFE) report that its profit sank 70% in the third quarter. Its acquisition of Wyeth did boost revenue by 39%. Like many other drug makers, Pfizer missed revenue expectations but beat earnings-per-share expectations. iShares Dow Jones U.S. Health Provider (NYSEArca: IHF) is up 2.3% so far today. [Biotech ETFs: A Better Way to Play.]

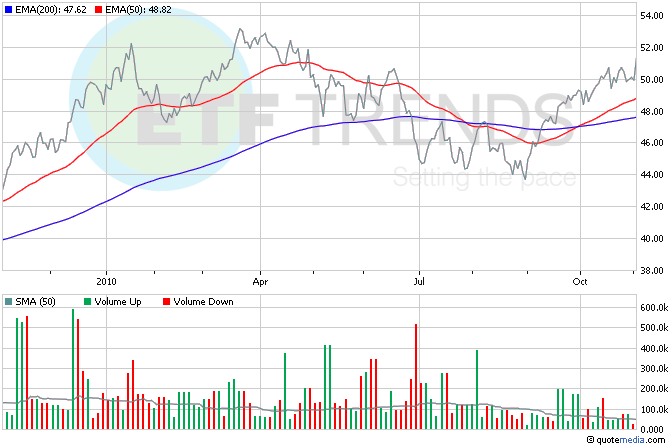

Here’s more discouraging news about the housing market: homeownership has fallen to its lowest level in a decade to 66.9%. The rise in foreclosures coupled with a lack of demand for housing took the numbers down close to what they were in 1999 at 66.7%. SPDR S&P Homebuilders (NYSEArca: XHB) is up 1.7% so far today. [Homebuilder ETFs Await Recovery.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.