ETFs are flat in early trading after a published report showed consumer prices climbed 0.2% last month, with the core rate remaining unchanged.

Rising gasoline costs offset flat or declining costs in other parts of the U.S. economy. The 0.2% CPI rise was below the 0.3% consensus estimate of economists. Core inflation, which excludes volatile food and energy prices, were flat for the third straight month and below the 0.1% growth that economists anticipated. On a yearly basis, the U.S. Labor Department reported core prices are now up 0.6%. This is well below the Federal Reserve’s target for inflation of about 2%. WisdomTree Dividend Top 100 (NYSEArca: DTN), which is one way to battle inflation, is up 0.3% so far this morning. [Dividend ETFs: Who’s Paying?]

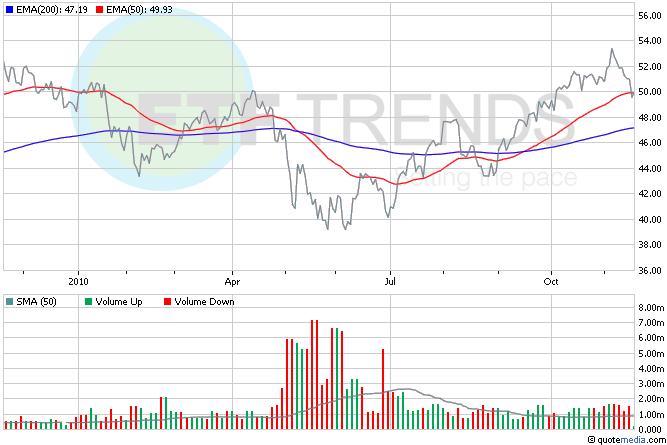

The Commerce Department reported that new home construction fell in October to its lowest level in 18 months, but the number of building permits issued rose slightly. Housing starts dropped 11.7% to an annualized rate of 519,000 last month, with virtually the entire decline occurring in the volatile multi-dwelling segment. Construction of condominium and apartment buildings with five or more units sank 47.5%. The last time starts were that low was in April 2009. New construction on single-family homes, which account for 75% of the housing market, barely fell dipping 1.1% from September. Of the two homebuilder ETFs, iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) is taking the reports hardest, falling 1% so far today. [Homebuilder ETFs Looking for Their Break.]

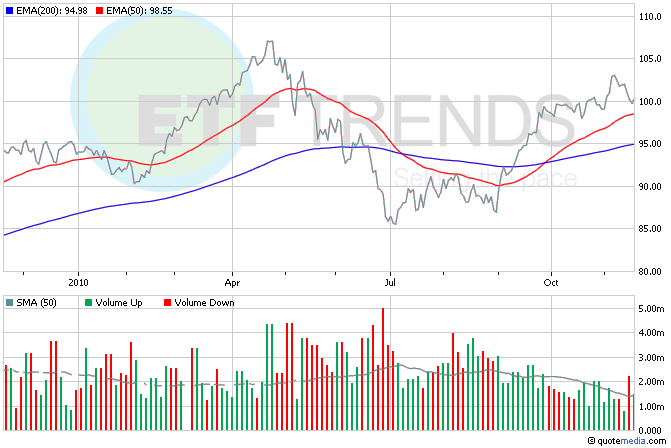

Investors also got some reassurance from news that European government officials began working on a possible rescue plan for Ireland. Officials from the European Union and the International Monetary Fund were scheduled to start talks with Ireland officials on Thursday – with an offer of additional help from the U.K., whose banks have the greatest exposure in the Ireland debt crisis. The Vanguard European ETF (NYSEArca: VGK ) is up 1% in early trading in response. [Debt Woes Create ETF Winners and Losers.]

Retailer Target (NYSE: TGT) shares are up more than 2% today after reporting better-than-expected third-quarter profit and forecast the best same-store-sales performance in three years for the current period, which covers the holidays. Target also forecast that holiday sales would surge to a three-year high. The Retail HOLDRs (NYSEArca: RTH) are up 0.5% so far today; Target is 8.6%. [Retail ETFs Gear Up for the Holidays.]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.