Strong economic data from Europe helped push Europe exchange traded funds (ETFs) and the broader U.S. markets higher this morning.

ETFs that track economies in Europe have moved to the front of the pack this morning, led by iShares MSCI Spain (NYSEArca: EWP) and iShares MSCI Italy (NYSEArca: EWI), both of which are up more than 3% so far today. [Europe ETFs: The Cup is Half-Full.]

The eurozone’s purchasing managers index was revised upward today, delivering a boost to the economies of the region and their currency, the euro. A major U.S. bank also purchased $1 billion of the euro, further adding to its upward momentum. CurrencyShares Euro Trust (NYSEArca: FXE) is up 0.8% so far today. [Gold, Treasuries and Dollar ETFs: Connecting the Dots.]

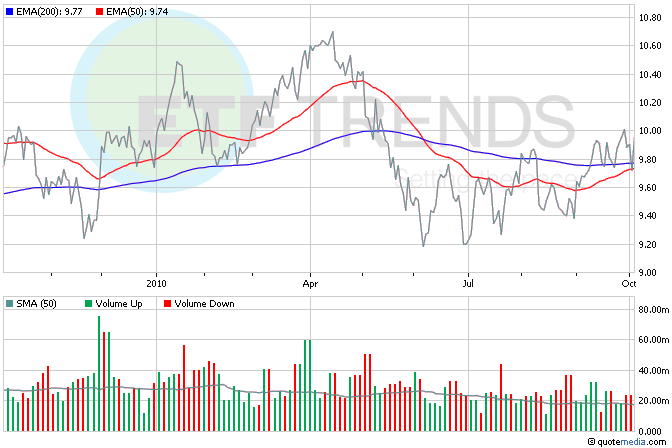

Japan surprised the markets by unveiling a monetary easing measure worth $418 billion. At the same time, interest rates were slashed to nearly zero. The move is aimed at stoking Japan’s flagging economic recovery and weakening the yen, the strength of which has hurt exports in the country. iShares MSCI(NYSEArca: EWJ) Japan is up 2.3% on the news; it could use the lift – in the last six months, it’s down 9.1%. [Strong Japanese Yen ETF Puts Country in a Quandary.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.