The U.S. stock market and exchange traded funds (ETFs) turned south early Tuesday following Apple’s (NASDAQ: AAPL) tepid pronouncement about future earnings and profits and China’s interest rate hike.

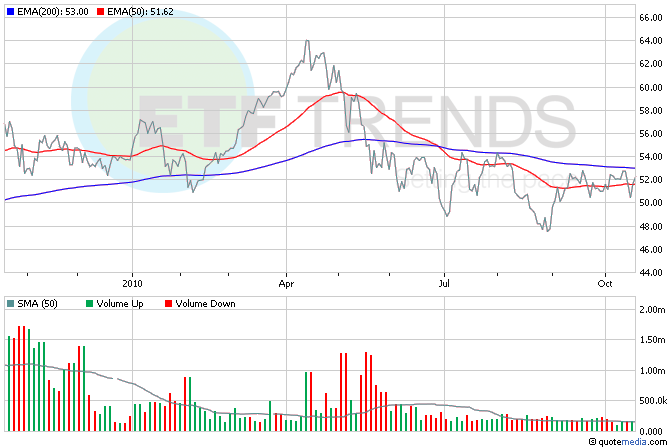

Apple did blow away estimates for its fourth-quarter results based on soaring earning from strong iPhone sales. But sales of the iPad fell well short of expectations and the company offered a relatively conservative forecast when they reported results after Monday’s closing bell. Also in the tech sector, IBM (NYSE: IBM) reported late Monday that third-quarter earnings and profit were about even with the analyst consensus forecast. Despite the reports, Technology Select Sector SPDR (NYSEArca: XLK) is down 1.4% this morning. [Finding Values in Tech ETFs.]

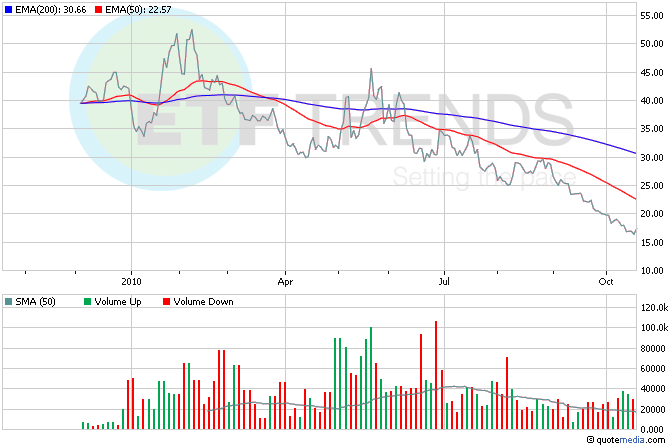

China surprised investors by moving to raise its key lending rate for the first time since December 2007. Wall Street is reacting negatively to China’s move to ratchet down the growth of inflation. The dollar is on the move up today after Treasury Secretary Timothy Geithner announced that the U.S. Government will not be looking to devalue the dollar. Gold is going down in early trading in response the continued dollar rebound. Direxion Daily China Bear 3x Shares (NYSEArca: CZI) is up almost 6% this morning. [Currency ETFs Get Ready to Rumble.]

Bank of America (NYSE: BAC) surprised many analysts by reporting a third-quarter loss attributed to a one-time charge associated with new debit and credit card reform legislation. Its shares are holding steady because the banks operating results did exceed forecasts, similar to the results that Citibank (NYSE: C) reported on Monday. Goldman Sachs (NYSE: GS) also reported quarterly revenue and profit exceeding analyst estimates. iShares Dow Jones U.S. Financial Services (NYSEArca: IYG) is up about 1% so far today; Bank of America is 9.9%; Citi is 8% and Goldman is 5.3%. [Financial ETFs Get Their Color Back.]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.