Continued strong reported corporate earnings are driving exchange traded funds (ETFs) higher in early morning trading, while all eyes turn to the currency wars and the G-20 summit.

Better-than-expected earnings are paying a large part in driving stocks to recent highs, but one troubling aspect is that revenue has not kept up. This suggests that companies are continuing to boost earnings by cost-cutting – eventually revenue will need to increase to maintain profit margins. The NASDAQ is the top-moving major index this morning; PowerShares QQQ (NASDAQ: QQQQ) is up 0.3% so far today. [Tech ETF Clues in IBM’s Earnings Report?]

What might be holding the market back from a stronger start is the possibility that investors may be restrained as finance officers from the Group of 20 Nations gather in South Korea amid concerns about the long-term economic outlook. G-20 officials are expected to make an attempt to soothe growing tension over currency exchange rates. PowerShares DB G10 Currency (NYSEArca: DBV) is up 0.6% in early trading. [Currency ETFs Ready to Rumble.]

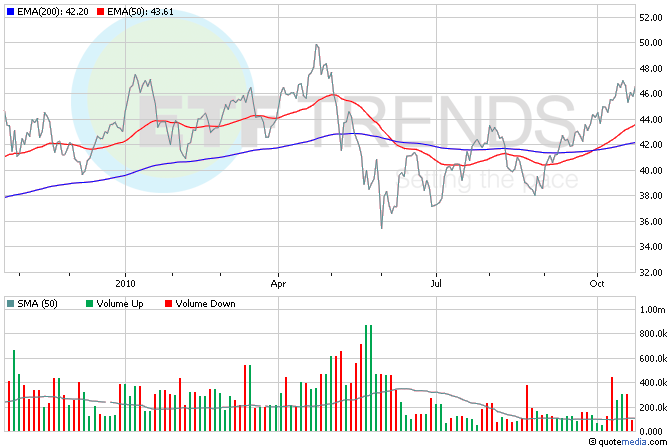

Oil company ETFs are moving up this morning, led by a good report from oil service giant Schlumberger (NYSE: SLB), which reported a nice increase in net income. iShares Dow Jones U.S. Oil Equipment & Services (NYSEArca: IEZ) is up nearly 2% today; Schlumberger is 17.3%.

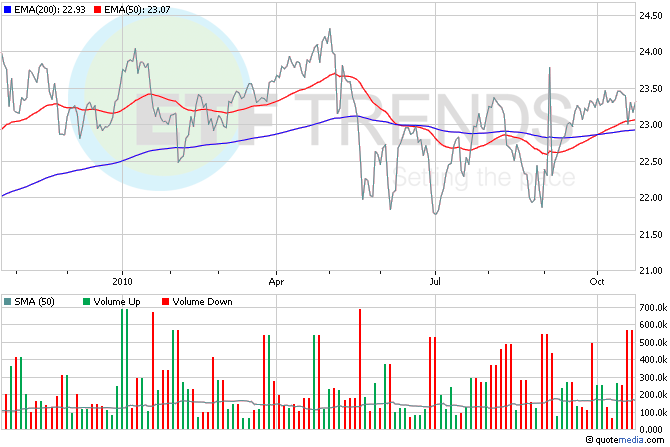

Another company on the downside is Verizon Communications (NYSE: VZ) who reported a whopping 25% revenue drop from a year earlier. Vanguard Telecommunications (NYSEArca: VOX) is down 0.3% early. Verizon is 22.4%.

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.