Japanese yen exchange traded funds (ETFs) have come so far so fast that many analysts are now watching for signs of a correction.

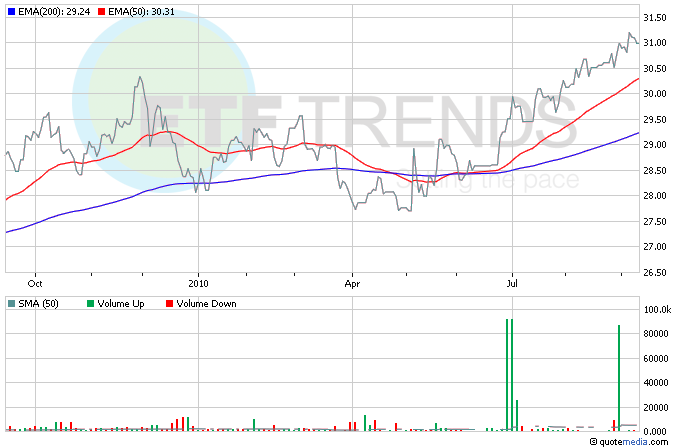

CurrencyShares Japanese Yen Trust (NYSEArca: FXY) has surged 7.3% in the last six months, a signal of the yen’s creeping strength. As questions about a double-dip recession linger, some wonder where the yen is headed next.

iStock Analyst reports that there are only a few currencies that can house and handle the massive liquidity to park large amounts of investment funds, and it appears the yen is among those today. The strength of the currency is also the downfall of the Japanese economy, as second-quarter GDP annualized growth rate was just 0.4%. It could potentially go negative in the coming quarters. [Is The Yen Strength Good For Japan?]

Anoojah Debnath for Reuters reports that despite the damage it may do to Japan’s growth, the currency will touch new highs in the near term unless the central bank gets bold and intervenes. [Travel the World With Currency ETFs.]

For more stories about currency ETFs and the Japanese yen, visit those categories.

- CurrencyShares Japanese Yen Trust (NYSEArca: FXY)

- WisdomTree Dreyfus Japanese Yen ETF (NYSEArca: JYF)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.