Stocks and exchange traded funds (ETFs) are flat in early trading as the markets consider what the Federal Reserve said and did yesterday.

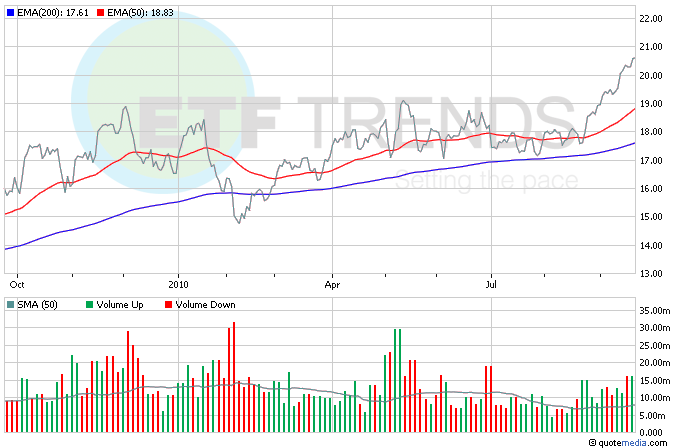

The big early mover is commodities, which are showing considerable strength as the dollar weakens. One of the early gainers, according to the ETF Analyzer, is PowerShares DB Base Metals (NYSEArca: DBB), which is up more than 2.5% so far.

Another day, another record high for gold and close to a 30-year high for silver. While the weakening dollar has a role in driving the metals higher, investors are lured in by their safe-haven attributes. Gold is inching toward $1,300; the metal was last seen touching $1,296.10. Meanwhile, iShares Silver Trust (NYSEArca: SLV) saw its largest one-day inflow in 10 months. [Why Investors Want Gold and Silver ETFs.]

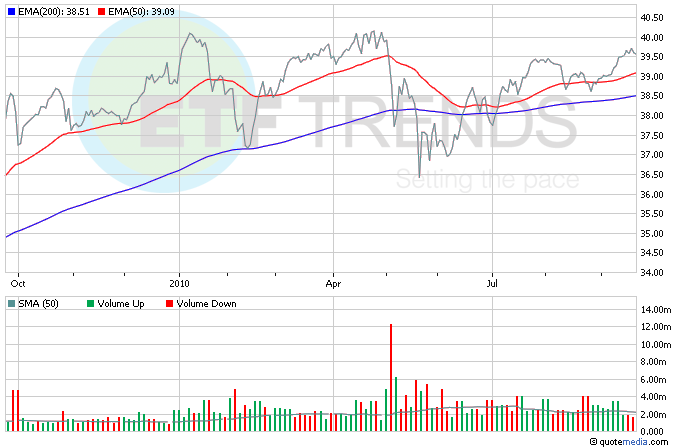

The picture for corporate debt is improving in a stunning rebound: default rates are on track to drop below the 2008 level, below 3%. That’s down from a high of 14.6% last fall. SPDR Barclays Capital High Yield Bond (NYSEArca: JNK) is down slightly this morning; in the last month, it’s up 1%. [Bond ETFs That Yield More Than Treasuries.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.