Weary markets kept their response to the drop in jobless claims this week tepid, despite the fact that the news comes on the heel’s of last week’s shocking report. Exchange traded funds (ETFs) and stocks were flat on the report.

The ETF Analyzer shows a mix of asset classes moving higher today, lead mostly by clean energy and metals ETFs. Leading the way is First Trust NASDAQ Clean Edge U.S. Liquid Series (NASDAQ: QCLN), which is up 3.6%.

Though the jobless report was a step in the right direction, manufacturing reports from Kansas City were not. Reports showed that activity in the region stalled in August, falling from 14 all the way down to zero, a sign that the sector has put on the brakes. PowerShares Dynamic Basic Materials (NYSEArca: PYZ) is unfazed, trading up 1.7% so far today. In the last month, it’s fallen 6.4%. [6 ETFs for the Potash Wars.]

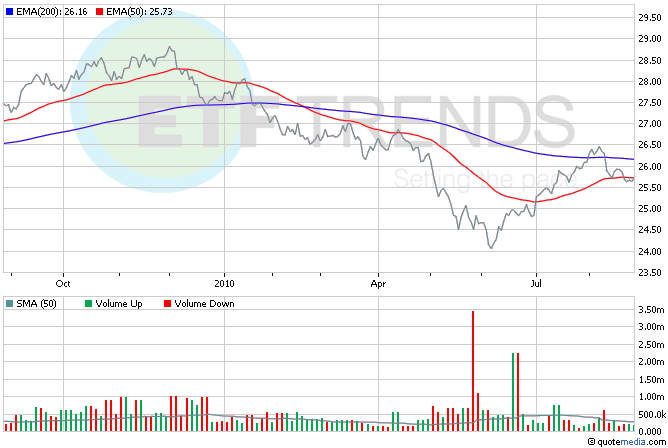

Speculation that the Federal Reserve will take steps to get the U.S. economy back on track has the dollar plummeting against its rivals today, falling to its lowest point since January against the Swiss franc. PowerShares DB U.S. Dollar Bearish (NYSEArca: UDN) is benefiting from the move, trading up 0.5% so far today. [Currency ETFs: What’s In It for You?]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.