A busy week of economic reports has the markets and exchange traded funds (ETFs) off slightly this morning. Investors are eager for clues about the economy, but nervous about what the numbers could reveal.

The ETF Dashboard shows that all major market indexes are trading lower this morning on concerns about the economic recovery:

The first economic report up was that old bugaboo: consumer spending. However, the numbers show that there wasn’t much to be nervous about, because spending rose at the strongest pace in four months last month. The gains were driven by small gains in personal incomes. Does this mean a turnaround? Not quite yet – we’re coming off some very low consumer spending levels as it is and shoppers are still sticking to the basics. PowerShares Dynamic Consumer Staples (NYSEArca: PSL) is up 2% in the last six months; today, it’s flat. [Luxury ETF Alternatives.]

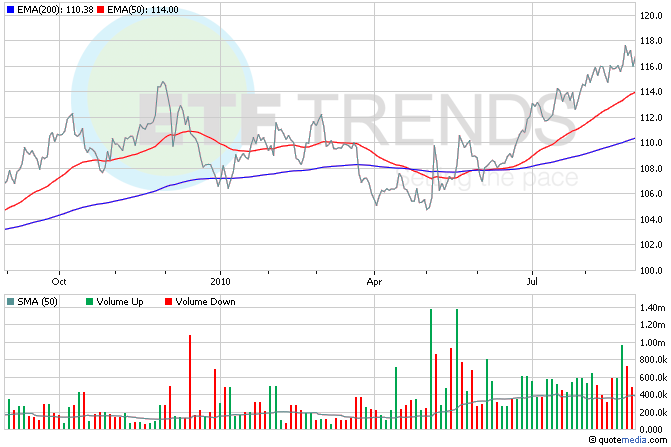

Japan offered up a stimulus package today in an attempt to stop the meteoric rise of the yen, but the impact wasn’t immediately apparent. The country’s central bank hopes that the $10.8 billion package will lend some support to the country’s fragile recovery and keep the yen from damaging it further. CurrencyShares Japanese Yen (NYSEArca: FXY) is up 0.7% so far today; in the last three months, it’s up 6.1%. [Strong Yen Puts Japan in a Quandary.]

Read this disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.