One of the more interesting products to come out of the financial crisis is Build America Bond exchange traded funds (ETFs), which give investors a direct way to play the recovery of our economy.

The Build America Bond program was created to help ease the liquidity crisis found in the bond markets after the financial crisis had wreaked havoc. When a state or local government issues a Build America Bond, it receives a cash subsidy from the federal government equal to 35% of the coupon interest rate on the bond, explains Morningstar for Yahoo Finance. [The Case For Build America Bond ETFs.]

More than $125 billion in Build America Bonds has been issued. The appeal is easy to see: interest rates are declining and Bush tax cuts are expiring, and it’s all contributing to a rush for tax-free municipal debt.

Build America Bonds have been so popular, in fact, that demand has outpace the supply – they’ve accounted for 21% of all municipal bond issuances since April 2009. [PowerShares Builds Up Build America Bond Line.]

As a new bill that enables Congress to make another attempt at extending several bond provisions slated to expire at the end of the year, including Build America Bonds, many millions of jobs have been created and helped pace a direction to recovery as a result. According to Build America Bonds Online, The Investing In American Jobs and Closing Tax Loopholes Act — HR 5893 — would extend BABs for two years. Also, the legislation would gradually reduce the subsidy rate for BABs from the current 35% level to 32% for bonds sold in 2011, and 30% for those sold in 2012.

For the latest news on Build America Bond, visit our category regularly.

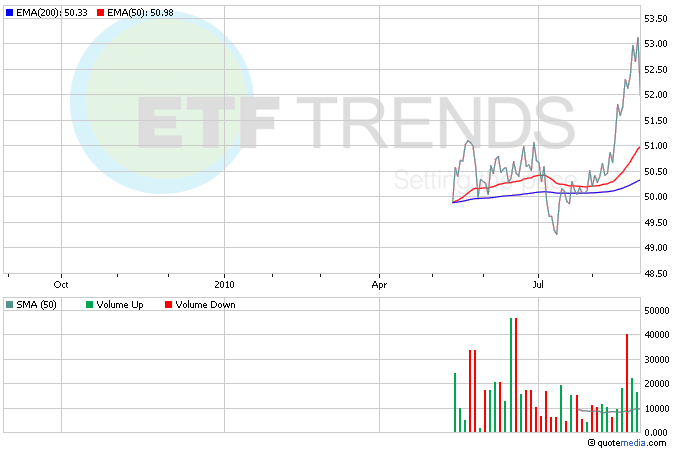

- PowerShares Build America Bond (NYSEArca: BAB)

- SPDR Nuveen Barclays Capital Build America Bond (NYSEArca: BABS)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.