If you’re among the investors who believe that gold exchange traded funds (ETFs) may have soared a little too high, then platinum bugs have a few suggestions for you.

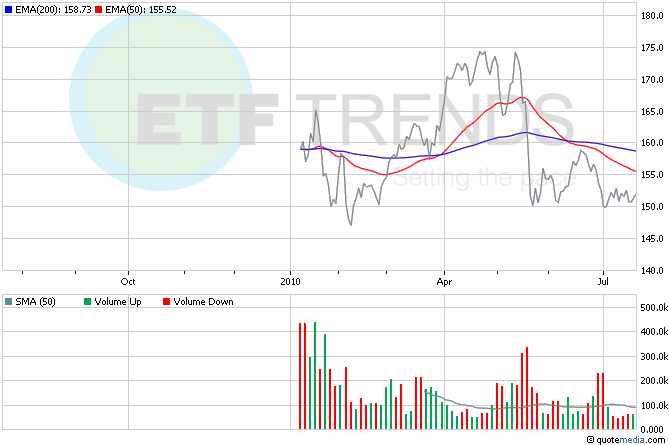

A buying opportunity may present itself for platinum over the next few months. Platinum’s price has dipped 15% since hitting a 21-month high in April. The metal now costs about $1,510 an ounce. But hold up: another fall of $200 may occur over the course of the next few months, Gary White and Rowena Mason for The Telegraph report.

Debby Carlson for Commodity Online reports that the possibility of a double-dip recession has many investors soft on the metals market at the moment. [Did the World Cup contribute to a platinum rally?]

Platinum watchers say that the metals may outperform gold over the next few years, so consider this a possible long-term opportunity. Demand in the fourth quarter is expected to improve and eventually the metal may hit an average price of $2,000 an ounce in 2013. [7 Other Commodity ETFs to Understand.]

What can you do? Keep an eye on the trend lines by searching for platinum ETFs in the ETF Analyzer and sorting by relationship to the 200-day moving average. We also offer alerts to premium members so you don’t miss an opportunity to buy platinum when a potential long-term uptrend is in the works.

For more stories about platinum, visit our platinum category.

- ETF Securities Physical Palladium (NYSEArca: PALL): down 22.7% in the last three months

- ETFS Physical Platinum (NYSEArca: PPLT): down 13.1% in the last three months

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.