In this low-yield environment, junk bond exchange traded funds (ETFs) have become an increasingly appealing destination for investors with a risk appetite.

Junk bonds may be the bond investment choice for investors now, as low rates help companies to borrow for expansion. Although few companies are taking out new loans at the month, low rates let companies and consumers refinance older, more expensive loans, explains John Waggoner for USA Today. [Why 2010 is the Year of the Junk Bond.]

To get the higher yield you may be seeking, a junk bond is one of the most popular way these days. But they come with some risks, including:

- Defaults. The peak default rate for junk bonds was 14.5%, set in November, according to Moody’s. It was 6.3% in June — better, but not great, either.

- Losses. During the worst 12-month period for high-yield bond funds, which ended last November, the average junk fund lost 30%, including interest.

Right now, the yield on a junk bond is 8.43%, says Waggoner. Tim Catts and Bryan Keogh for Bloomberg report that there is speculation that defaults among the neediest borrowers will diminish as profits exceed forecasts. The economy is showing signs of strengthening with more than 83% of companies in the Standard & Poor’s 500 Index exceeding the average analyst profit estimate this quarter.

Even if the economy is growing at a snail’s pace, interest rates could stay at lows, heightening the appeal of these high-yielding investments – if you’ve got the stomach. [The Optimistic Junk Bond ETF Investor.]

For more stories about junk bonds, visit our bond category.

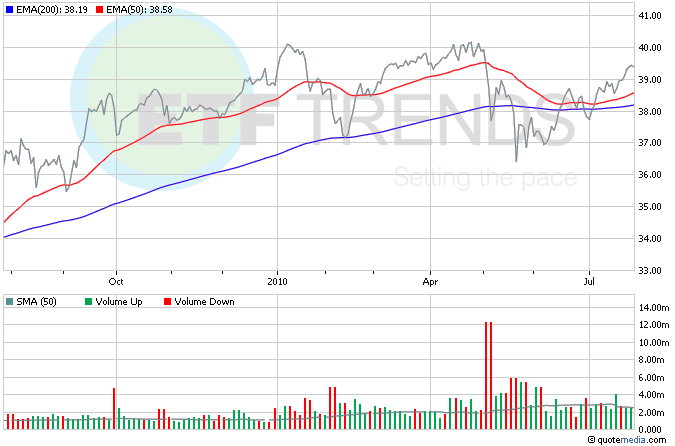

- iShares iBoxx $ High Yield Corporate Bond (NYSEArca: HYG): Yields 8.43%

- SPDR Barclays Capital High-Yield Bond (NYSEArca: JNK): Yields 9.66%

For full disclosure, Tom Lydon’s clients own shares of JNK.

Tisha Guerrero contributed to this category.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.