The markets and exchange traded funds (ETFs) powered ahead in early trading, with the Dow rising more than 200 points. But that’s not on the back of much positive news about the American economy.

We’ve perused the ETF Trends Dashboard to find the early-morning winners and losers. There are few ETFs trending down in early trading, thanks to a busy morning of economic reports:

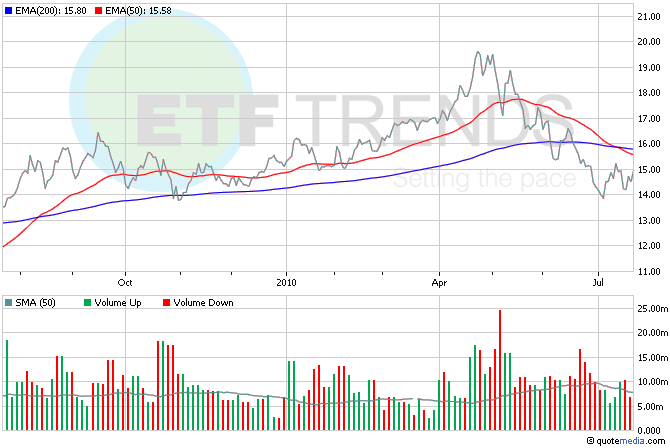

First up is yet more gloomy news from the housing sector: existing home sales declined 5.1% last month, and those sales are expected to continue to decline despite mortgage rates hitting a new record low. That said, the housing figures weren’t as bad as some had feared, which was enough to propel the SPDR S&P Homebuilder (NYSEArca: XHB) up nearly 3% higher this morning. There is no ETF that directly tracks the existing home market. If you’re looking for REIT or other homebuilder funds, you can find them in our Analyzer by searching “homebuilder” or “REIT.” [Homebuilder ETFs Lose Steam, REITs Gain It.]

Leading indicators, which are a signal of future economic activity, fell in June. It was the second drop in three months and is taken to mean that the recovery will slow even further through the fall. Housing sector weakness, declining consumer spending and high unemployment are contributing to those fears. Retail ETFs seem to tell some of the story: our Analyzer shows that best ones are focused on consumer staples, most of which are still down by 0.8% in the last week. Consumer discretionary fares worse, losing 2.5% or more in the last week. The top consumer staples ETF in that time period is the First Trust Consumer Staples AlphaDEX (NYSEArca: FXG), which is up 1.1%. [Luxury ETF Takes a Hit.]

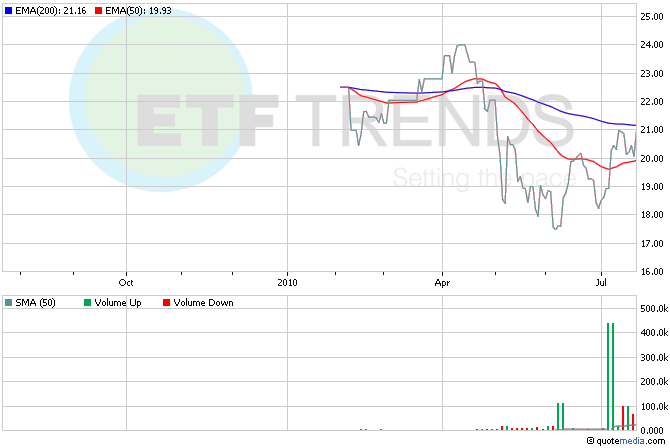

According to our Dashboard, Europe ETFs were the big gainers early this morning, with single-country funds like Italy and Spain leading the way. iShares MSCI Europe Financials Sector (NYSEArca: EUFN) is the top broad Europe ETF this morning, up close to 5%. [10 Steps to an International ETF Portfolio.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.