What a difference a few weeks makes. After months of being in the doldrums, euro exchange traded funds (ETFs) are riding high once again, surging close to 4% higher in the last week alone and is 6% higher than a month earlier. Is this for real?

Some analysts believe so. John Dessauer told MarketWatch that he’s more optimistic about the euro’s prospects than he was just three months ago for a few reasons:

- Greece may actually be able to avoid defaulting on its debt

- Weaker governments in Europe seem to be going for the idea that monetary discipline is the answer to their problems

- The crisis might lead to changes that in the long-term will be very positive for the euro

- The European Central Bank left interest rates low today, further supporting economic recovery in the region [ETFs for a Greek Tragedy.]

Despite the early evidence, though, Paul LaMonica at CNN Money wonders whether it’s a sucker’s rally. The European bank stress test figures won’t be out until July 23, and depending how they emerge it could spark either more fear or relief. He points out that when the United States did some stress tests, Americans were reassured about their banking system. [Euro ETFs Riding High, But Can It Last?]

You can find information on any euro ETF by visiting our ETF Analyzer and typing “euro” into the search box.

For more stories about the euro, visit our euro category.

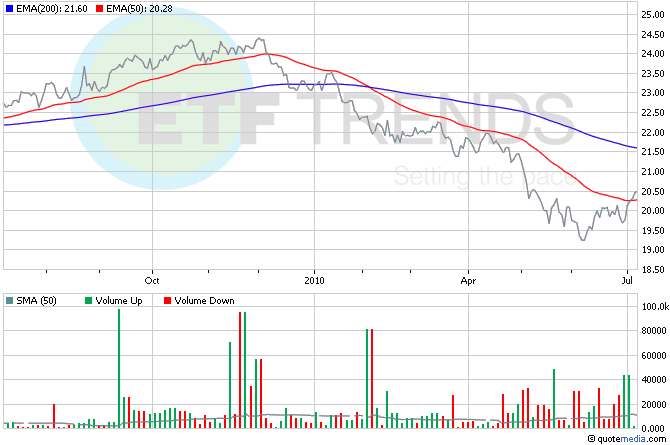

- WisdomTree Dreyfus Euro (NYSEArca: EU)

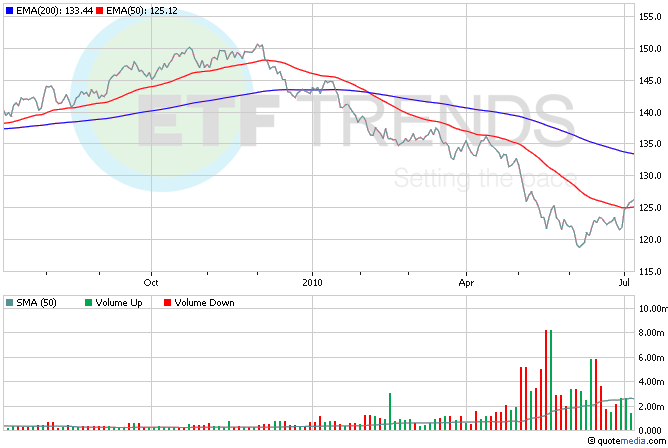

- CurrencyShares Euro Trust (NYSEArca: FXE)

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.