Earnings season doesn’t officially start until next week when Alcoa Aluminum (NYSE: AA) releases its second-quarter results, but that won’t stop the prognosticating. The financial sector has received a rosy forecast, boosting stocks and exchange traded funds (ETFs) that track the sector.

Guidance from State Street sparked the rally. The money manager projected a second-quarter profit that would beat forecasts, which in turn lifted expectations for the broader sector this earnings season. Concerns about any legislation targeting Wall Street’s largest banks have been pushed to the back burner, if the Financial Select Sector SPDR (NYSEArca: XLF) is any indication: it’s up 2.4% so far today. [ETF Strategies for Financial Reform.]

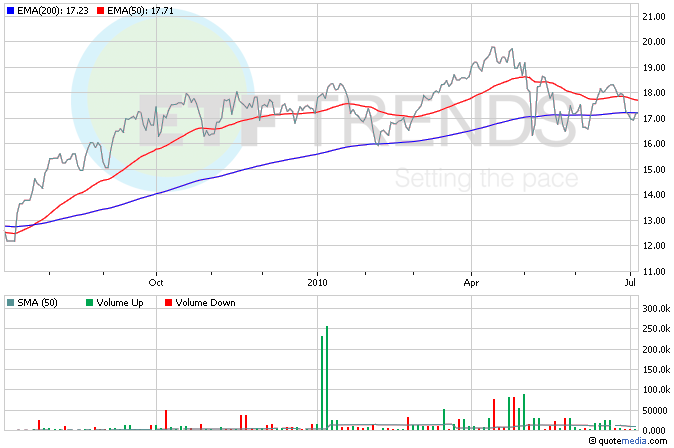

The success of the country’s retailers appears to be resting on the backs of the richest shoppers. Sales grew at the fastest pace in four years, expanding at a monthly rate of 4% in the first five months, an encouraging sign that consumers are getting less depressed about home sales and joblessness. Sales at luxury retailers led the way with an 8% jump. It’s no surprise, then, that the Claymore/Robb Report Global Luxury (NYSEArca: ROB) ETF is up even a little year-to-date; most retail ETFs are down. [Tom Lydon Talks Luxury on CNBC.]

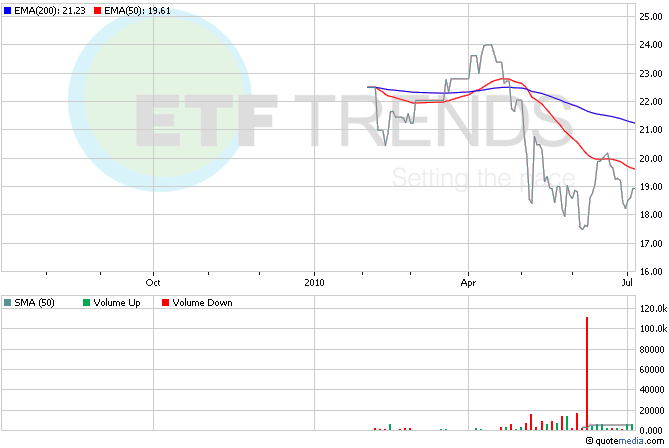

Speaking of financial reform, Europe is taking aim at its banking industry. The European Union is prepping for a series of “stress tests,” but ahead of that, the group of countries is now forcing its banks to show a little control. The European Parliament passed a law that imposes strict limits on bank pay, barring bankers from taking more than 30% of their bonus in cash. The law goes into effect in 2011. iShares MSCI Europe Financials (NASDAQ: EUFN) is so far today flat on the news. The fund tracks an index of banks in the United Kingdom, France, Switzerland, Spain, Germany and other countries in smaller allocations. [6 ETFs That Could Be Affected by a European Banking Crisis.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.