For a country to really grow, its infrastructure needs to be built up and maintained. There are developed and emerging markets that need major upgrades. Here are five exchange traded funds (ETFs) that you can use to play along.

Brazil. Investors may believe that everything is going well for Brazil’s economy, but former Central Bank President Arimnio Fraga believes that Brazil’s infrastructure is in “terrible shape” and the country isn’t saving and investing enough for the sector, reports Veronica Navarro Espinosa for BusinessWeek. The infrastructure sector in Brazil may need as much as $85 billion in financing over the next decade, says Ricardo Flores, V.P. for credit at Banco do Brasil SA. Brazilian Cabinet Chief Dilma Rousseff has stated that the country will commit around $11 billion to improve the infrastructure and prepare for the World Cup. [Ways to Play the Brazilian Economy.]

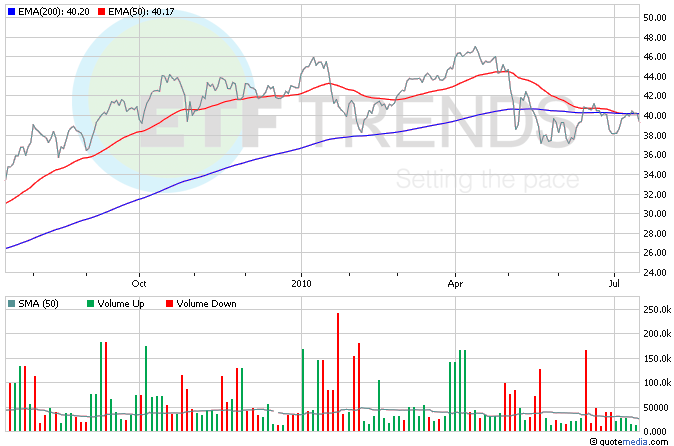

- EGS INDXX Brazil Infrastructure ETF (NYSEArca: BRXX)

China. There has been a slowdown in government-led investment after the billions in stimulus money poured into the economy last year. Still, the government will need to enact reforms to facilitate rural-urban integration for its growing population and labor market, according to the World Bank. The country will have to balance a sustained urbanization with future migration flows. Additionally, industrial upgrading and a “rebalanced” growth model will shift activities across the country. [Infrastructure ETFs Backed By Big Opportunities.]

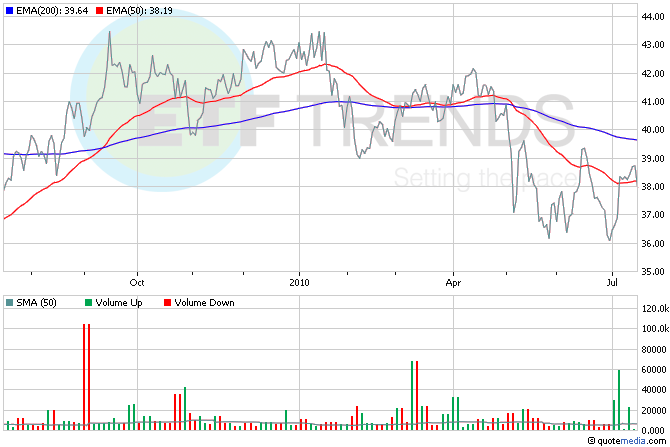

- Emerging Global Shares INDXX China Infrastructure (NYSEArca: CHXX)

South Africa. An expected $107 billion in additional infrastructure expenditure will be required over the next three years, and the infrastructure industry in South Africa is projected to grow by 4.14%, according to Official Wire. In anticipation of hosting the World Cup, the industry has seen phenomenal growth, but growth may slow. Energy and utilities may grow to a value of $5.45 billion in 2011 and rise to $7.02 billion in 2014. The transport infrastructure industry is projected to grow by 10% to $1.57 billion in 2010, 8% year-over-year between 2011-2013 and slid to 6.33% in 2014.

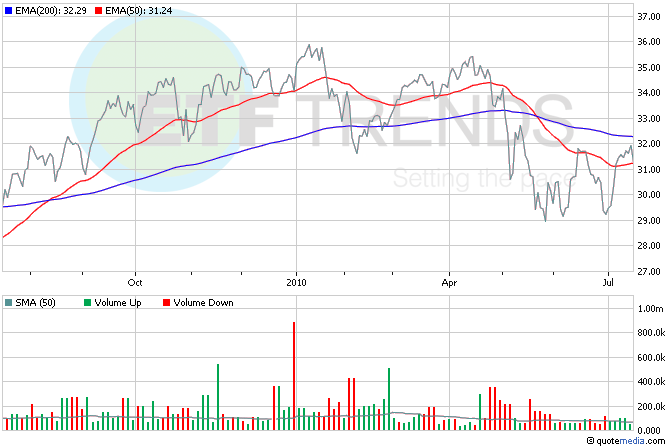

- PowerShares Emerging Markets Infrastructure (NYSEArca: PXR). South Africa is 10.5%.

United States. Our country’s infrastructure is getting old and outdated, says Popular Mechanics. Freeways are becoming more congested, some rickety bridges have been deemed “structurally deficient,” canals for carrying imports and exports aren’t efficient, water shortages have become normal, dams are disintegrating and the list goes on. It will require billions in additional funding to fix all the problems that plague the country’s infrastructure.

- SPDR FTSE/Macquarie Global Infra 100 (NYSEArca: GII). U.S. is 40%.

- iShares S&P Global Infrastructure Index (NYSEArca: IGF). U.S. is 24.3%

These aren’t the only infrastructure ETFs in town, either. A quick search in our ETF Analyzer reveals nine such ETFs; sorting by performance, Emerging Global Shares‘ China infrastructure fund is the top performer in the last month.

For more information on the infrastructure industry, visit our infrastructure category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.