Today marks “quadruple witching” – the simultaneous expiration of four types of options and futures contracts. Quadruple witching days are often marked by volatility in stocks and exchange traded funds (ETFs).

Although the euro is weaker against the dollar today, the currency is still at three-week highs. This week’s eurozone debt auctions went a long way in soothing investor sentiment, although there are still concerns about how solvent these countries really are. The European Union plans to release the results of its bank “stress tests,” which could further assuage fears (or stoke them if the news is bad).

- CurrencyShares Euro Trust (NYSEArca: FXE): up 2% in the last week

Everyone is mad for gold, and it’s little wonder why: the precious metal hit a record high closing price of $1,248.70 this week. The buyers include everyone from individual investors, institutions and foreign governments. Annalyn Censky at CNN Money says that foreign entities aren’t much different from other investors – they want to diversify, too. Although the U.S. dollar is the most typical reserve asset, gold is not far behind because it’s tangible and independent of any country’s economic policies.

- SPDR Gold Shares (NYSEArca: GLD)

Could President Barack Obama be gearing up for a clash with Chinese officials? He’s heading to a summit next week and ahead of the trip, he called for market-determined exchange rates in a letter to the G20. Beijing told the world not to criticize its currency policy just before that, but he’s clearly ignoring the directive. Obama’s letter urges partners to step up their efforts on financial reform.

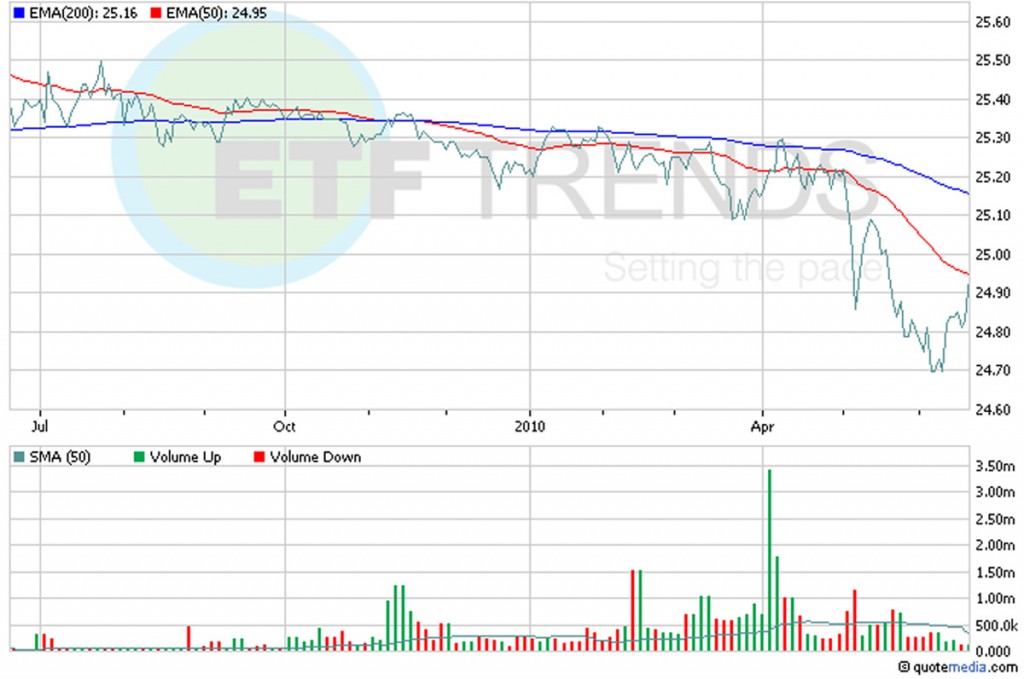

- WisdomTree Dreyfus Chinese Yuan (NYSEArca: CYB)

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.