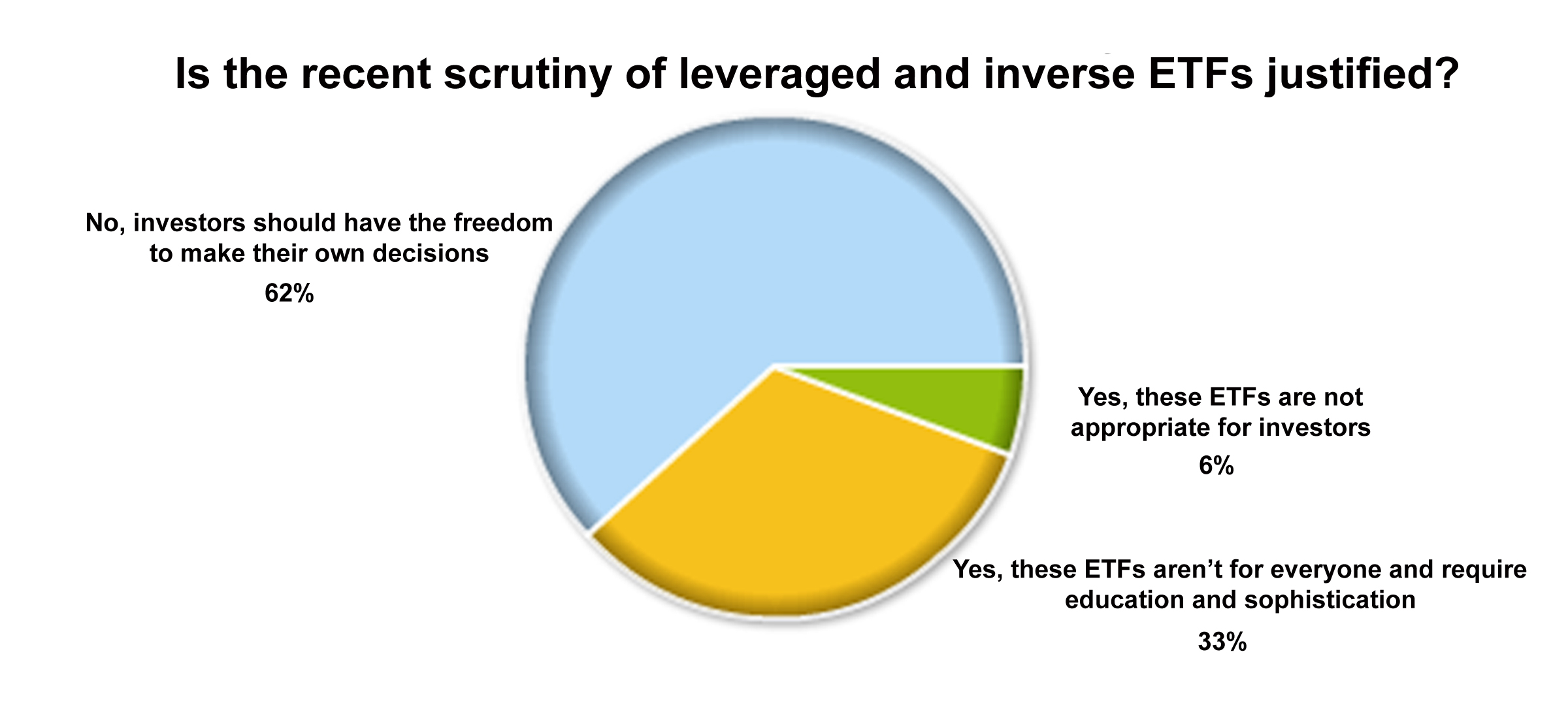

We asked and you answered. In response to our query about whether the scrutiny of leveraged and inverse exchange traded funds (ETFs) is justified, many of you spoke out by voting in our poll. Now the results are in!

Many investors seem divided about whether leveraged and inverse ETFs are deserving of the scrutiny and criticism they’re receiving, but our poll results show that most of our readers feel that the ETFs should be left alone and investors should be free to make their own decisions.

(click to enlarge)

Rick, an ETF Trends reader, left a comment on the poll in defense of the funds:

Nobody is forcing anyone to use them against their will. And I say this even though my last trade (FAZ) was a big loser. Hey, you can’t win them all. When the opportunity is right (for me), I plan to use a leveraged (or inverse leveraged) ETF again.

A similar poll conducted by Ignites showed results that were somewhat in line with our own. In their poll, 51% of respondents said that that regulators weren’t justified in singling out the funds. 27% said they were justified, and 23% said that they were justified, but that other financial products needed scrutiny, as well.

For more stories about leveraged and inverse ETFs, visit our long-short ETF category.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.