Recent economic reports in Japan are signaling that the lost decade they just went through may be turning into two lost decades, and the markets and exchange traded funds (ETFs) could be sensitive to that.

Japan’s economy stagnated in the 1990s after its stock market and property bubbles burst, but its more recent economic performance looks even more troubling. Industrial production plunged by 38% in the past year, mirroring 1983, reports The Economist. Recent forecasts by the Organization for Economic Co-Operation and Development (OECD) note that Japan’s GDP may shrivel 6.6% in 2008, wiping out any gains from the past five years.

This would leave Japan stagnating, with 16 years lost. The economy is projected to fail even more as the second round of the recession hits the country, with unemployment high and consumer spending dried up. According to the latest Tankan survey of the Bank of Japan, in March business sentiment among big manufacturing firms was the gloomiest since the poll began in 1974. Manufacturers say they plan to cut investment by 20% this year. In turn, more jobs and wages are lost.

Fiscal stimulus aside, the government has discovered that Japanese households’ stash of savings is equivalent to more than five times their disposable income, the highest of any G7 economy, and three-fifths of it is held by people more than 60 years old. If a gift tax were to fall, there would be more disposable income for the younger generation, who would inherit this wealth. They could help lead the country out of a recession.

Nonetheless, a jump start of this economy is necessary for a domestic recovery to be strong enough.

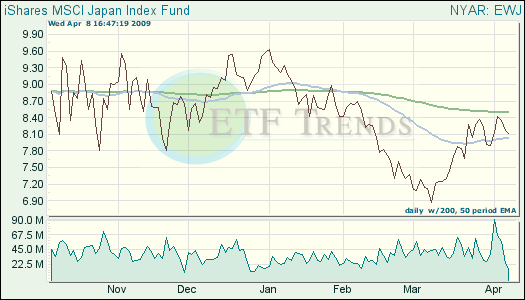

- iShares MSCI Japan Index (EWJ): down 11.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.