Results of the government stress tests are in and the results about the financial health of 19 of the largest banks in the United States are trickling in, sending shares in financial exchange traded funds (ETFs) down.

While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, reports Robert Schmidt and Rebecca Christie for Bloomberg. Conversions will help the public remain calm and help quell any bitter feelings toward the sector at large. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.

According to Bloomberg, six banks did fail the stress tests. Henry Blodget on The Business Insider on Cluster Stock reports that the government wants these banks to raise capital by converting preferred stock to common stock, which would stave off the need for additional capital injections. Debtholders would be required to do the same. Citigroup (C) and Bank of America (BAC) are two of the institutions mentioned.

John Carney for The Business Insider on Cluster Stock reports that these moves and results have more people talking about regulation, reform and the need for a makeover of the large financial institutions. In the 1920s, the financial sector was far less intertwined with the political apparatus than it was after the reforms that emerged from the Pecorra Commission and the New Deal. Nowadays, lawmakers and politicians are so intertwined with Wall street that some feel we lack the tools for a total, worthy reform of the financial industry.

More on the stress test results and what will become of the banks are expected to be out next week.

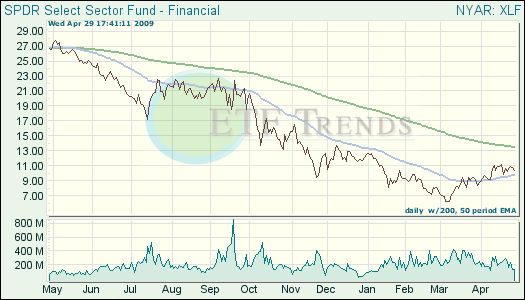

- Financial Select Sector SPDR (XLF): down 12.3% year-to-date; J.P. Morgan Chase 13.2%; Wells Fargo 7.9%, Goldman Sachs 6.5%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.