Cap-and-trade systems sound great in concept, however, American power producers are weary of the expenses involved, and will U.S. markets and exchange traded funds(ETFs) be supported by such a system?

House lawmakers are busy scrutinizing a bill aimed at climate change and global warming, which could ultimately affect the way business is functioning in the United States. Jennifer Collins for MarketPlace says that utility companies are concerned about expenses involved in a cap-and-trade system, which would require utility companies to buy the right to pollute. Will these expenses then be passed down to the consumers?

In response, the Democrats are considering that 40% of permits can be given away to power producers, which is a fair argument for the struggling sectors. Regions dependent upon coal and utilities serving low-income populations, to be specific. The trade-off? Free permits mean the government makes less money – money that’s supposed to fund alternatives to fossil fuels.

This was the initial purpose of the cap-and-trade system, to supply the government with a steady and dependable revenue stream. The upside is that it may become less expensive for some companies to reduce their emissions below their required limit than others. These companies can turn around and sell their allowances to companies who aren’t as efficient, according to the Center for American Progress.

- Utilities Select Sector SPDR (XLU): down 11.7%year-to-date

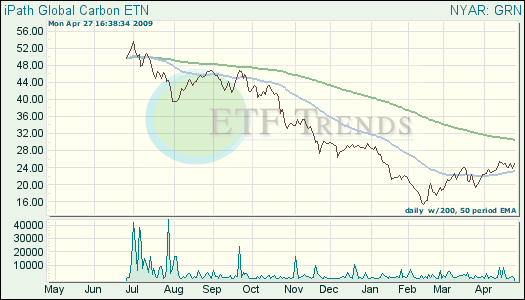

- iPath Global Carbon ETN (GRN): down 13.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.