While oil has been in and out of the market spotlight, the sub-sector of energy refiners has taken a back seat. Exchange traded funds (ETFs) reveal that their performance could be worth watching.

Refiners are the most ignored sub-sector within the energy sector. It seems like the broader market has also ignored the refiners, as they have not participated in the energy rally that started on March 3. Bullish Bankers on Seeking Alpha say that many investors are told to avoid the refiner area of the energy sector by advisors because of their business model, which is tough to understand on a macro-economic level.

The refiners are the sub-sector of the S&P Energy Composite which go undetected. While pure-play refiners only make up roughly 3.5% of the entire composite, if you include other companies’ refining operations, the number is closer to approximately 20% of the composites revenues depending on the quarter.

Day-to-day market moves should be watched, as this sub-sector can be volatile. Names that stand out in the refining industry include: Valero, Sunoco (SUN), Hess (HES), Tesoro (TES) and Western Refining (WNR).

Refiners have been cutting back on fuel production several months ago, and have yet to step it up despite the looming summer, says Brian Baskin for Dow Jones Newswires. The warm season usually brings peak gasoline demand, but unwanted oil is sitting in storage. The price of oil is just around $50 per barrel today.

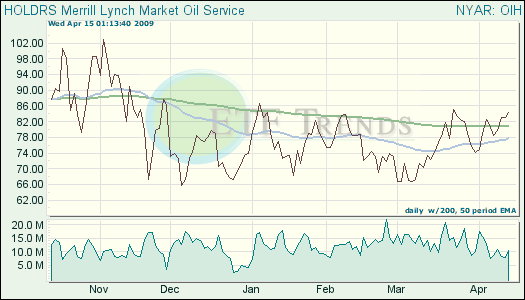

- Oil Services HOLDRs (OIH): up 4.4% year-to-date

- Energy Select Sector SPDR (XLE): down 5.3% year-to-date; Hess 2.10%; Valero 1.43%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.