Life insurers are now eligible for government capital injections because they have the status of bank holding companies, and focused exchange traded funds (ETFs) may benefit.

A number of life insurance companies have met eligibility requirements for government capital, and their applications are being considered, reports David Lawder for the Associated Press. They were able to meet requirements by virtue of their bank holding company status.

In addition to Met Life (MET) and Prudential (PRU), other insurers with such status include the Hartford Financial Services Group Inc. (HIG) and Lincoln Financial.

Such a move would help stabilize the life insurance industry, which has suffered massive investment losses over the past year. Ieva M. Augustums for the Associated Press reports that insurers have been under enormous pressure to keep ratings up and maintain solid capital positions. Lower ratings mean higher costs and higher costs equal possible loss of business.

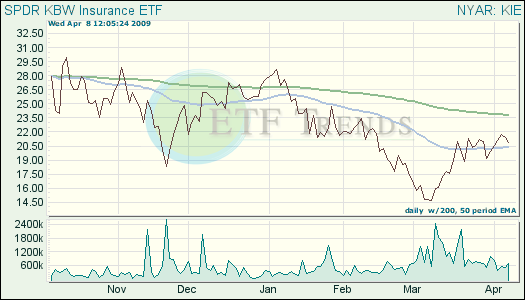

- SPDR KBW Insurance (KIE): down 23.9% year-to-date; Prudential Financial 3.9%; Hartford Financial 2.1%; Lincoln National Corp. 1.8%

- iShares Dow Jones US Insurance (IAK): down 26.6% year-to-date; Prudential Financial 4.9%; Hartford Financial 1.7%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.