Municipal bonds are proving to be a winning asset class in the past year, as yields are decent and related exchange traded funds (ETFs) gave well-rounded, low cost exposure.

Retirees and income-oriented investors alike enjoyed gains averaging 4.6% in the six national, short and intermediate-term tax-free municipal bond ETFs on the market. Municipal bonds have been overlooked because of their slow, but sure nature.

Chance Carson for Index Universe reports that the muni-bond area is proving to be a safe haven in these current market conditions. Under “normal” market conditions, the tax-free municipal bonds usually yield less than taxable bonds. Since the market is upside-down right now, the non-taxable bond can actually offer better yields than most.

Since states and towns can raise taxes to meet debts, muni bond defaults are extremely rare (but still possible). If you’re looking for high yields and low taxes, munis look like one of the best deals out there, says John Waggoner for USA Today.

Some of the municipal bond focused ETFs on the market:

- iShares S&P National Municipal Bond (MUB): up 0.89% year-to-date, yields 3.55%

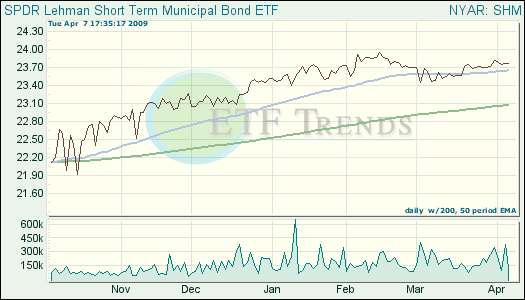

- SPDR Barclays Capital Short-Term Muni Bond (SHM): up 1.6% year-to-date; yields 2.52%

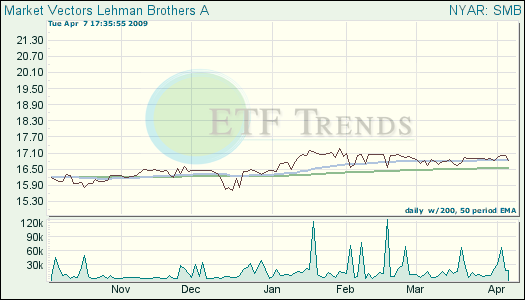

- Market Vectors Short Municipal ETF (SMB): up 3% year-to-date; yields 2.57%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.