Exxon Mobile (XOM) is showing its strength as plans for expansion and investments are set in place amid the recession, giving some energy to exchange traded funds(ETFs).

The oil company is bucking the trend so many other companies are following. Instead of slicing and dicing, they’re showing their strength by stepping up their investments over the next five years. Jad Mouawad for The New York Times reports that the company is not swayed by a collapse in oil prices or the most severe global financial crisis since the 1930s.

The giant plans to spend as much as $150 billion through 2014. Exxon already earned $45 billion in 2008, gave back $40 billion to its shareholders, invested $26 billion around the world and managed to find more oil than it produced.

Russell Gold for The Wall Street Journal reports that Exxon played conservative with investment in years prior while capitalizing on high oil prices, giving the company the room to boost spending on energy exploration and production by 11% to $29 billion this year, even as many of its rivals are cutting costs.

But the only concession to the depressed economic outlook that Exxon has made is to cut its share buybacks to $7 billion this quarter, down from $8 billion in each of the previous four. No major adjustments have been made to the business strategy.

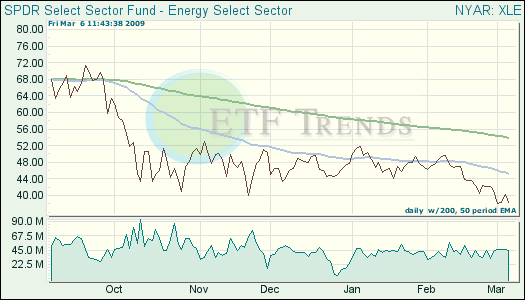

- Energy Select Sector Energy Fund (XLE): down 19.7% year-to-date; down 9% for one week; XOM is 22.8%

Meanwhile, China is rumored to be considering buying crude oil as part of its strategy to diversify holdings from U.S. Treasuries. This will be used as a hedge against the risk of U.S. Treasury prices dropping and dollar depreciation in the long run, since the Obama administration is issuing government bonds worth trillions to finance economic stimulus measures, reports Mandar Nikmar for Economic Times.

China has been building a national stockpile of oil since 2004, and is planning to stock 100 billion barrrels by next year. Real purchases, rather than speculation, is driving the price of oil up overseas.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.