The semiconductor industry is no stranger to booms and busts, but the most recent economic turmoil is taking their sector and exchange traded funds (ETFs) by surprise as they’re trapped in the gears of such a cycle.

Swift Slowdown. The sales for a majority of manufactured goods are down, which is to be expected from time to time. In January alone, however, chip sales plummeted to $15.3 billion. That’s down by nearly one-third from from the previous year, reports Ashlee Vance for The New York Times.

The chief sales and marketing officer at Intel said, in fact, that this recession is the worst the industry has ever seen.

What Happened? In the last couple of years the production of memory chips swelled as companies chased rising interest in consumer gadgets, but this has led to major over supply and falling prices. While consumers have made out with the conditions so far, taking laptops and SmartPhones at deep discounts, the factories are still bulging with unsold inventory.

What’s Going to Happen? Some think that the market is looking at consolidation if the situation deepens. Already established makers could also be able to better fight off challenges from start-ups. Some companies may also just up and disappear.

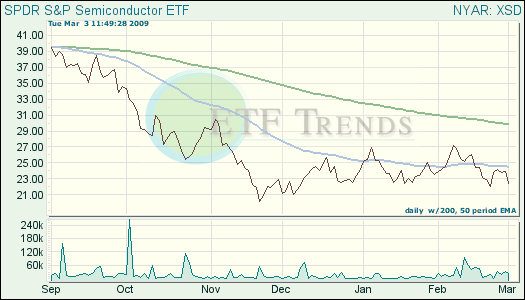

- SPDR S&P Semiconductors (XSD): down 7.1% year-to-date; up 1.6% over one week; top holdings are Cree 5.9%; Micron Technology 5.8%; ON Semiconductor Corp. 5.5%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.