On Monday, the S&P 500 broke through its November lows, giving the broad index a bad two-month start for 2009, and many, including exchange traded fund (ETF) investors, say there are 10 companies that led the index down to despair.

Kate Gibson for Yahoo Finance explains that the companies that make up the S&P 500 tallied a collective $114 billion in losses in the still-being-reported fourth quarter. The scenario would be remarkably different, and profitable, however, if just 10 companies behind $131 billion in losses were removed from the picture.

- SPDR S&P 500 (SPY) is down 22.4% year-to-date

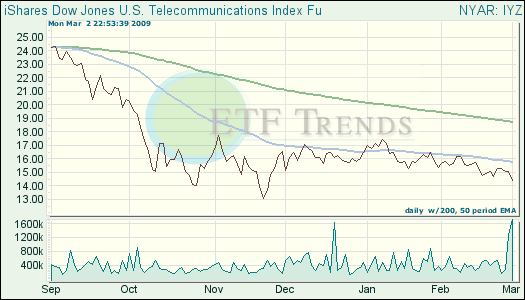

The 10 worst losses accounted for $131 billion in losses, leaving the remaining 490 issues with positive earnings, however, how many investors actually only purchased stocks from those six issues then? While all 10 sectors of the S&P fell during the first two months of 2009, telecommunications fared the least poorly, shedding just 2.8%.

Fronting the declines in particular were energy, materials and industrials.

Some of the companies that brought the S&P 500 down include: ConocoPhillips (COP), Time Warner (TM), Merril Lynch/ Bank of America (BAC), General Motors (GM), Symantec Corp. (SYMC), among others.

- Industrial Select Sector SPDR (XLI): down 31.8% year-to-date

- iShares Dow Jones U.S. Telecom (IYZ): down 12.7% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.