President Barack Obama’s administration launched a housing plan aimed at keeping 9 million borrowers in their homes, hoping to lay the groundwork for a recovery within markets and exchange traded funds (ETFs).

The new program is designed to keep 9 million homeowners in their homes, through refinanced mortgages or loans that are modified to lower monthly payments. The administration, launching what it calls the “Making Home Affordable” initiative, said that borrowers will have to provide their most recent tax return and two pay stubs, as well as an “affidavit of financial hardship” to qualify for the $75 billion loan modification program, which runs through 2012, reports Alan Zibel for the Associated Press.

Undermining the housing weakness is the unstable job market. U.S. private sector job losses went up in February, suggesting substantial employment declines in governments payroll reports due on Friday. ADP said on Wednesday that private employers cut 697,000 jobs in February versus a revised 614,000 jobs lost in January, reports Burton Frierson for Yahoo Finance.

The service sector shrank for the fifth straight month in February, a result of growing layoffs and a deepening recession. Marcy Gordon for the Associated Press reports that the Institute for Supply Management reported that its services index fell to 41.6 last month from 42.9 in January.

The past five days of heavy selling within the stock market has spurred a move higher for stocks. The latest government plan to help troubled homeowners and the Chinese stimulus plan has given investors the sign they need for a possible recovery. Sara Lepro for the Associated Press reports that industrial and commodity-related stocks, boosted by a sharp increase in oil prices, are leading the market.

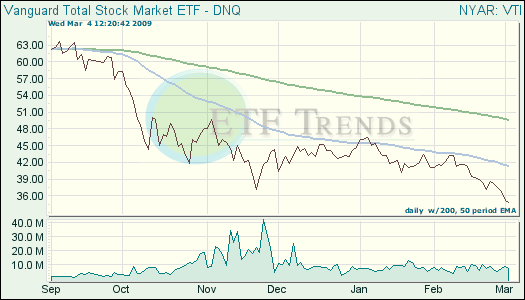

- Vanguard Total Stock Market ETF (VTI): down 22.2% year-to-date; down 9.7% for one week

Oil rose $1.65 to $43.30 a barrel in electronic trading. Last week, refiners ramped up operations to help increase demand, helping oil prices rise up. MYMEX crude oil futures jumped 8%, reaching above $45 per barrel, reports Reuters.

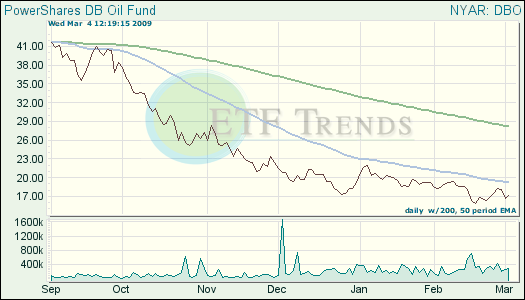

- PowerShares DB Oil (DBO): down 11.3% year-to-date; up 1% for one week

Costco (COST) profits are down 27%, as discounting hurt margins and the strength of the dollar eroded international revenue. Lauren Coleman-Lochner and Sarah Shannon for Bloomberg report that net income fell to $239.7 million in the quarter ended Feb. 15, down from $327.9 million. International outlets open at least a year declined 11% in the three-month period.

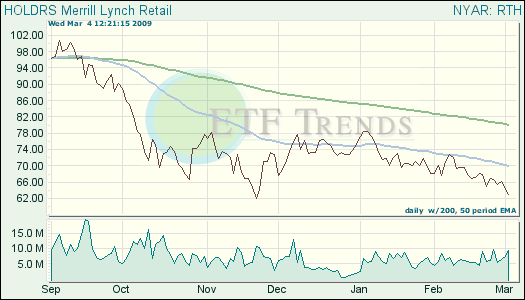

- Retail HOLDRs (RTH): down 10.7% over three months, down 5.7% over one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.