Oil production could be cut by as much as 8 million barrels per day within the next five years, and that could be priming consumers and exchange traded funds (ETFs) with a jolt when the economy recovers.

Jad Mouawad for The New York Times reports that the global recession has forced many companies to cancel plans, slash investments and delay drilling in many corners of the Earth.

The danger lies ahead in how production ca be handled once demand picks up. Producers would find it challenging to bolster supplies even to 90 million barrels a day by the middle of the next decade as projects get canceled.

Global oil demand is headed for its second consecutive drop this year. As the slowdown in investments take place, it will translate into higher prices if demand gathers steam (and many believe this will eventually happen again).

Oil is currently below $53 per barrel after hitting a high for 2009, Louise Watt for the Associated Press reports.

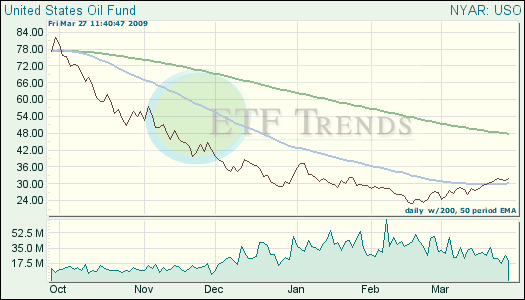

- United States Oil (USO): down 3.3% year-to-date; up 5.5% for one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.