Interest in gold from battered and confused investors is evident in the performance and popularity of gold- and silver-focused exchange traded funds (ETFs).

Financial Times explains that gold broke the $1,000 per troy ounce last month, driven by the credit crunch and volatile markets. The periods of strong momentum the metal has experienced in the last year leads one to wonder if the gold insanity can continue, or whether it will become a victim of profit-taking.

Suki Cooper on the Commodities Research team at Barclays Capital focuses on precious metals markets, covering gold, silver, platinum and palladium. She made a few points about gold in a q&a with readers of the Financial Times:

- A weakening dollar would appear to support an uptrend in gold prices, but the opposite is not always true. Just because the dollar is strong does not mean prices will stop appreciating. In the current rally, gold prices have sustained even though the traditional drivers haven’t supported it.

- In Barclay’s view, prices are likely to make a sustained move above $1,000 in the second half of the year.

- Investors buy gold for a range of reasons: a dollar hedge, an equity hedge, a volatility hedge, inflation hedge and as a safe haven.

- Mine supply is stabilizing and jewelry demand is weakening; offsetting that is a wave of investment demand.

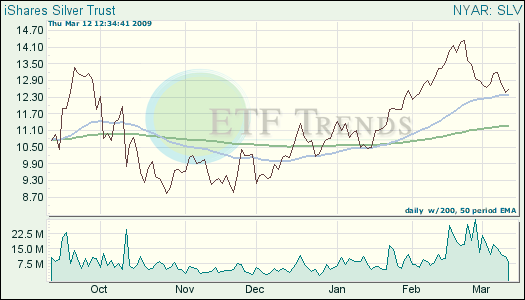

- Silver’s uptrend has been fueled by gold’s gains instead of it’s own fundamentals. Current levels imply that silver is undervalued, while gold is overvalued. Dorothy Kosich for MineWeb reports that Silver enjoyed a strong run last month which saw the metal’s price rise 16% compared to gold’s 11% rise.

- The fundamental outlook for silver has deteriorated, and Cooper says the underlying supply and demand outlook for silver remains unfavorable. The mine supply is set to grow.

- Cooper expects palladium’s fundamentals to remain weak because of a low demand outlook (the metals is primarily used in gas vehicles, and the United States is a key market).

- Platinum’s outlook also remains dim, Cooper says, as most of the demand is centered around the auto industry, which is in dire straits right now.

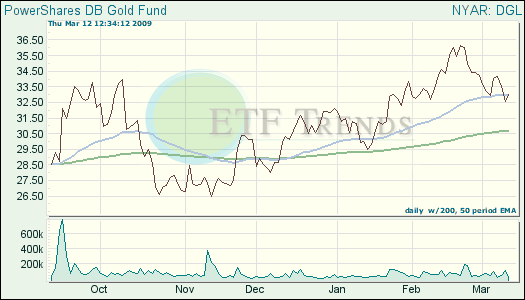

- PowerShares DB Gold (DGL): up 17.5% in the last three months

- iShares Silver Trust (SLV): down 31.9% in the last three months

- iPath DJ AIG Platinum ETN (PGM): up 26.9% for the last three months

Discuss Commodity ETFs in our forums.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.