Wal-Mart (WMT) sales performance for the month of February beat analysts expectations, and gave a boost to the retail sector, and related exchange traded funds(ETFs).

Among the reasons for the success of this discount chain:

- Wal-Mart is raising its stock dividend by 15%, to $1.09 per share. Many other companies have done the opposite, some even forgoing payouts to make up for the slowing economy.

- Wal-Mart is diversified – it’s everything to everyone. Clothes, food, games, plants, bedding and more, it’s all right there and at low prices.

- Falling gas prices gave consumers more disposable spending money than earlier on, but not so much that they’re ready to splurge.

- The discount chain has been doing well because of the upswing in bargain-hunters and consumers trading down from name brands to generic items.

- As consumers stay home for dinner, they’re needing more equipment to fix their budget feasts – enter Wal-Mart and its inexpensive appliances and cookware.

- They’re ubiquitous. Chances are, you’ve got a Wal-Mart in your neighborhood. Check out this hypnotic map of how it’s expanded across the country since its humble beginnings in 1962.

The world’s largest retailer reported a 5.1% increase in sales at U.S. stores open at least a year, however, there is nothing certain that stabilization has occurred, reports Kerry R. Grace for The Wall Street Journal . Retail sales rose 0.3% in February according to final figures from Thomson Reuters. A 1.2% drop was expected, reports Karen Tally for CNN Money. Discounters carried the day, with comparable store growth of 2.9%.

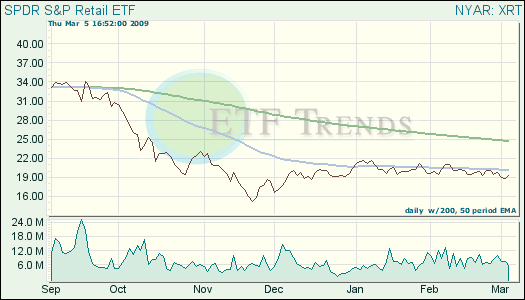

- Retail HOLDRs (RTH): down 16% year-to-date; Wal-Mart is 26.9%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.