Spain is experiencing a deep and intense recession, so is a dip toward deflation following a 40-year low in inflation good news for markets and exchange traded funds (ETFs)? Not so fast…

The year-on-year inflation for this European country is down to 0.8% for January, and is anticipated to turn negative due to lower fuel costs. Financial 24 reports that Friday’s data showed the dip toward deflation was being driven by the plunge in global oil prices, rather than a paralysis in Spanish consumer demand.

Deflation is a precarious situation, as it can be a difficult cycle to break.

However, Spain’s core inflation is still 2%, which accounts for fresh food and energy. Service sector inflation is at 3.6% compared to Germany at 1.2%, so the bottom is far off. One economist reports that the service sector is holding position because of a lack of competition and declining inflation is likely to bottom out around -0.3% in May before picking up in the second half.

The European Central Bank sees wider Eurozone consumer prices slowing until midyear and is expected to cut interest rates 0.5% in March. The country cannot wait for this, as unemployment in the EU is at 14.4%. Meanwhile, the stimulus plan in Spain should begin to take effect over summer

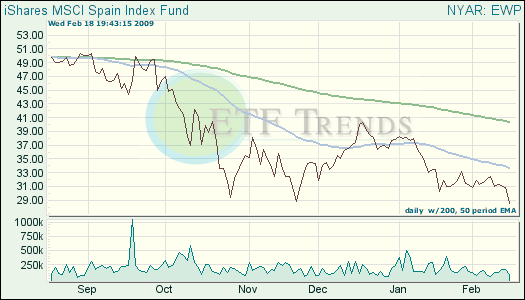

- iShares MSCI Spain Index (EWP): down 9.4% over three months; down 9.7% in one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.