It seems like oil and gas prices are toying with us and our emotions: oil falls off a cliff, related exchange traded funds (ETFs) take a spill, and yet each time we drive by the local gas station, the prices seem to be a few cents higher. What the h-e-double hockey sticks is going on here?

Scott Jagow for the Scratch Pad at Marketplace reports that, unfortunately, logic does not always apply when it comes to gas prices. It’s natural for people to assume that gas prices would fall as oil prices fall, but the relationship between the two isn’t always perfectly correlated.

- Oil prices are tanking because we’ve simply got too much of a backlog. There haven’t been reserves like this since 1990, when Iraq invaded Kuwait. No one wants much oil right now.

- Refiners are primarily independent companies or operations that make decisions based solely on what’s known as the “gas crack.” It’s value of the gas over the value of the oil. Since gas prices got too low last year, companies cut back on refining an an effort to drive the price of gas up, and so the cycle goes.

Oil production and gas refining are separate things. Gasoline refining is essentially a U.S. market. More than 90% of the gasoline used in the United States comes from the United States. Less than 40% of the crude oil used by our refineries comes from this country.

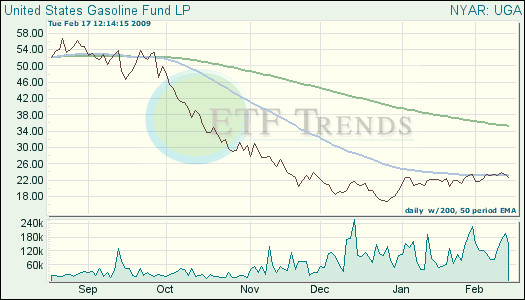

- United States Gasoline (UGA): down 16.3% over past three months

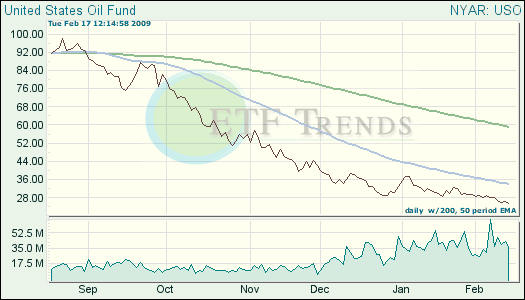

- United States Oil (USO): down 47.8% over past three months

According to Bloomberg News, crude oil is near $37 a barrel in New York on speculation a deepening recession in Europe and Asia will stifle demand for energy and fuel. Japan, the world’s third-largest oil consumer, said that its economy contracted the most since 1974 in the fourth quarter.

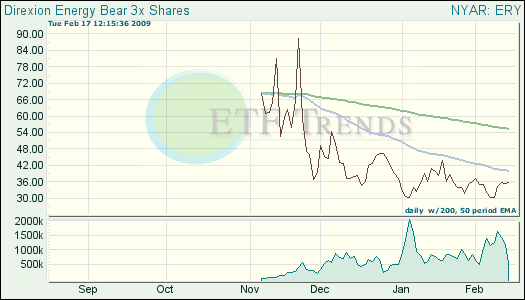

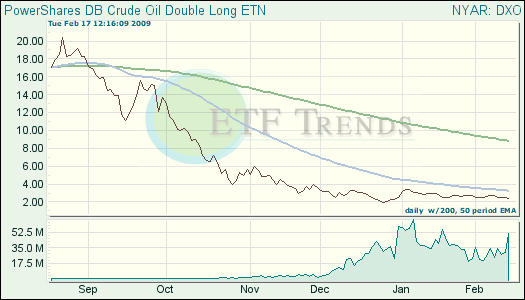

The market data and numbers coming fro the United States, and major economies are not showing any sign of a recovery in the near future. Crude oil for March delivery traded at $36.85 a barrel, down 68 cents from the Friday close. Bull and bear ETFs should be seeing some reaction to all this volatility.

- Direxion Energy Bear 3X Shares (ERY): up 17% for one week

- PowerShares DB Crude Oil Double Long ETN (DXO): down 12.3% for one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.