A new capital assessment program will be launched on Wednesday, helping banks in need of capital to receive funding, and keeping larger institutions viable; markets and exchange traded funds (ETFs) could stand to benefit if the plan sticks.

U.S. banking regulators are going to provide more capital to banks as needed, through the Capital Assistance Program. U.S. Treasury Secretary Timothy Geithner announced this as part of a larger bank rescue plan that will include the creation of a public-private partnership to mop up toxic assets on banks’ books.

David Lawder for Yahoo Finance reports that any government capital under the new program will come in the form of mandatory convertible preferred shares, which would be converted into common equity shares only as needed over time to keep banks well capitalized.

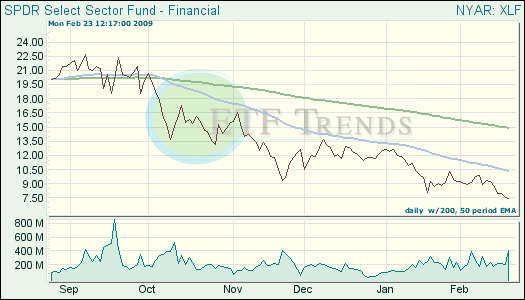

- Financial Select Sector SPDR (XLF): down 19.6% over three months; down 15.9% over one week

Oil prices are hovering around the $40 per barrel mark despite production cuts by OPEC. OPEC cut around 4 million barrels of crude per day, reports Chris Kahn for Associated Press. Benchmark crude for April delivery fell 13 cents to $39.90 a barrel on the New York Mercantile Exchange.

The production cuts can not compare to the million of unemployed workers staying home, and the companies that have cut back on spending. The demand is low and the situation will not improve overnight.

- United States Oil (USO): down 26.4% year-to-date; down 4.9% in the last week

Both General Motors (GM) and Chrysler are seeking additional aid in the billions from the government, as their situations are worse than anticipated. The Chicago Tribune Staff reports that in exchange, each promised more reductions in products, production and jobs, though few specifics were provided.

The nature of their situation is volatile, and if the economic downturn continues, they have warned of potential bankruptcy. Millions more would be needed to stave off liquidation, and the loss of millions in taxpayers money would result if the carmakers were to go under.

Their plans now go to the Obama administration to determine whether they are worth funding. If not, the $13.4 billion in loans already issued to them could be called March 31, which would likely make bankruptcy necessary. GM has called March 31 the day of a necessay turnaround plan, because they will be tapped out of money.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.