An unexpected surge in wholesale inflation occurred in January, as a result of higher gas prices and energy costs, giving markets and exchange traded funds (ETFs) a lot to grapple with.

Rising Gas Prices. Martin Crutsinger for the Associated Press reports that the Labor Department said Thursday that wholesale prices increased by 0.8% last month, the biggest gain since last July and well above the 0.2% increase that economists had expected.

The main contributor to the higher inflation was a jump in gas prices by 15%, and a 3.7% surge in energy prices. Economists are predicting that inflation is not looming threat and that the recession is too deep to let it factor in.

Good News? The private sector saw a boost in economic activity, for the second consecutive month, due to the increasing money supply. Vinnee Tong for the Associated Press reports that the indicators rose 0.4%, which forecasts economic activity for the next three to six months based on 10 economic components, including stock prices, building permits and initial claims for unemployment benefits. It’s a step in the right direction, but we’re not out of the woods by a long shot. One economist said that in the second half of the year, the United States will see “anemic” growth, followed by more robust growth in 2010.

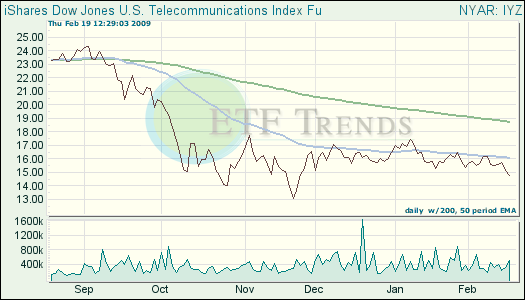

Holding the Line. Sprint Nextel Corp. (S) is not seeing a change in their real money supply, as more subscribers are lost, and $1.62 billion was taken as a fourth quarter loss. Roger Cheng for The Wall Street Journal reports that the wireless carrier lost 1.3 million subscribers in the fourth quarter – still an alarmingly high rate – but suggested the declines were stabilizing as predicted. The subscriber losses were equal to the third quarter, and left Sprint with 49.3 million customers.

- iShares Dow Jones U.S. Telecom (IYZ): down 0.5% over three months; down 4.8% over one week; Sprint is 4.8%

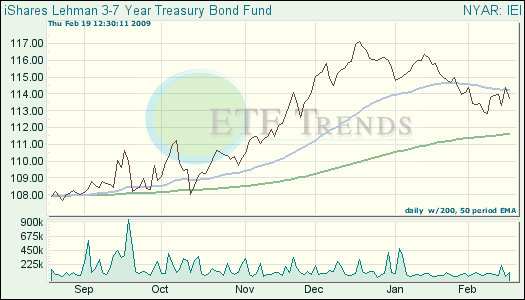

Producer Price Index. Treasuries are down after the recent report that the producer price increases rose by more than expected, and speculation is mounting that the Unites States may need to build yields to attract buyers at auction next week. The government will sell a record $94 billion of two-, five- and seven-year notes next week, reports Susanne Walker and Kim-Mai Cutler for Bloomberg.

The yield on the benchmark 10-year note is forecast to drop to 2.63% by March 31, according to a Bloomberg survey, and the 30-year bond yield increased to 3.63%.

- iShares Barclays 3-7 Year Treasury Bond (IEI): yields 2.8%; up 1.6% over three months; down 0.1% for one week.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.