The index of pending sales for pre-owned homes rose 6.3% to 87.7 in the final month of the year from an upwardly revised November reading of 82.5, reports Tim Paradis for Associated Press. The news was weighed down with the mixed corporate earnings reports and economic uncertainty.

Citigroup (C) is going to spend $36.5 billion to issue mortgages, give credit card loans and buy troubled assets during the coming months, reports Madlen Read for Associated Press. Funds received from TARP will be used to implement this plan, after $45 billion in capital was injected into the bank.

- iShares Dow Jones U.S. Real Estate Index Fund (IYR) down 13% for the past month

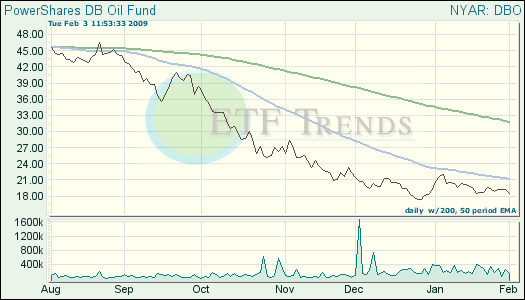

Oil is flirting with the $40 per barrel mark, as OPEC is debating production cuts once again. Light, sweet crude rose to $40.69 a barrel on the New York Mercantile Exchange, reports Chris Kahn for Associated Press. Analysts ponder if production cuts are the main driver for pushing demand for the commodity right now.

- PowerShares DB Oil (DBO) down 11.1% for one month

Job losses are not finished, and disappointing corporate earnings reports are undermining the situation. Grim news from these companies include:

- PNC Financial Services Corp. (PNC) is cutting 5,800 jobs, reports Leva M. Augustus for Associated Press. Revenue fell 3% to $1.68 billion from $1.63 billion.

- Chrysler’s sales chief reported that industry sales could drop up to 35% for the year, the lowest in 25 years. Ford’s (F) January sales plunged 40%, reports Tom Krishner for Associated Press.

- Dow Chemical Co. (DOW) reported a $1.55 billion loss due in large part to restructuring costs including its decision to slash 11% of its work force and a 23% drop in sales amid a global slump, says James Prichard for Associated Press.

- UPS (UPS) is hit by the economy as their quarterly profit is worse-than-expected. Cost-cutting measures include eliminating package handling operations, freezing management salaries, and freezing 401(k) contribution plans, reports Nick Carey for Reuters.

- Motorola (MOT) is expecting fourth quarter reports today, and analysts are calling for a 9% drop sales drop this year. Forbes reports that this is the first industry wide downturn in cellular service.

On a better note, Merck (MRK) and Schering Plough (SGP) reported better than expected fourth quarter profits. A large-scale acquisition is in the works for the future. The year before losses were incurred by charges, with cost cuts helping to offset unfavorable currency- exchange rates and sluggish sales growth for some products, reports Peter Loftus for CNN Money.