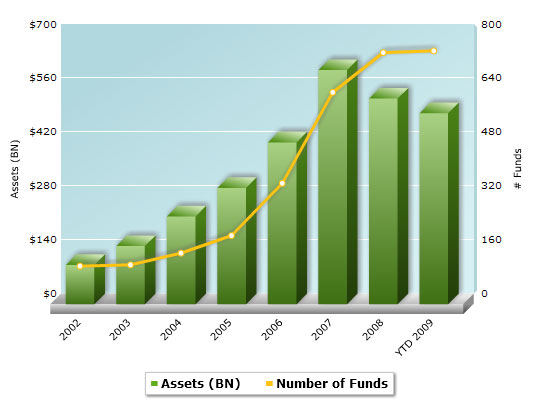

The exchange traded fund (ETF) industry at large is not so bad off, despite the constant stream of bad press that the markets are receiving. While the industry has taken hits along with the broader market, the progress remains solid and proves that ETFs are an investing staple.

According to the State Street ETF Snapshot, as of Jan. 31, 752 ETFs in the US — with assets totaling approximately $496BN — were managed by 22 ETF managers. The ETF industry assets were down 7%, or $37.6 billion. Meanwhile, nine ETFs were launched in the month, and four closed up shop.

Comparatively, the S&P 500 fell 8.4% in January; MSCI EAFE fell 9.8% for the month in USD terms. The Barclays Capital U.S. Treasury Index lost 2.9% while the Lehman U.S. Aggregate Index fell 0.9%. Gold climbed to $919.50 an ounce, an increase of 5.7% from December’s close.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.