Recent economic reports tracking countries in Eastern Europe have underscored the severity of the economic crisis for the emerging area, and taken their toll upon related stocks and exchange traded funds (ETFs).

Of the Eastern European economies, Estonia had the most disappointing numbers, with an economic contraction of 9.4% for the fourth quarter of 2008. Polya Lesova for MarketWatch reports that other Eastern European regions had a hard year as well: Hungary’s GDP fell by 2% year-on-year in the fourth quarter, while Slovakia’s GDP grew by 2.7% and the Czech Republic’s economy grew by 1.0%. Contraction occurred during all four quarters of the past year.

The region does not seem like it will be able to sidestep a recession after the recent GDP numbers were released. Contraction for the year for the region is expected to be at 3%. Eastern Europe was viewed as the most sensitive region when considering financial and economic risk. Hungary, Slovakia and the Czech Republic are all heavily dependent on exports to Germany.

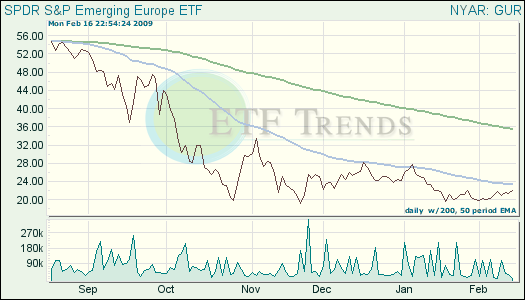

- SPDR S&P Emerging Europe (GUR): down 22.6% year-to-date; Hungary 5.4%; Czech Republic 7.4%; Poland 13.4%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.