According to new figures published, Europe’s economy has sunken even deeper into a recession than the United States, taking a new view of markets and exchange traded funds (ETFs).

In a Funk. The recent data was revealed to the finance ministers of the seven leading industrialized nations, the Group of Seven, as they gathered in Rome for the debate on the financial crisis. The European Union stats office reported that the economy of the 16 countries sharing the euro was down 1.5% for the fourth quarter.

On an annualized basis, that would indicate a contraction of 6 % — considerably deeper than the 3.8% annual rate of decline in the American economy in the same quarter, reports Eric Pfanner for The New York Times. The performance was worse-than-expected, and it was the most noticeable in Germany, Europe’s largest economy.

That Isn’t All. One senior economist predicts that Europe faces at least three more quarters of contraction. The economy also has to brace for more unemployment. The central bank may cut interest rates to a record low, along with other measures to prevent this from happening.

Shrinking Economy. Jan Strupczewski for the Associated Press reports that the Eurozone did in fact suffer the worst contraction in 13 years at the end of 2008, with Germany, France and Italy leading the plunge. These are the largest contractions in Europe on record, thus far. Despite the news, stock markets remained intact, with European shares up 2%. The strength was in the U.S. plan to rescue troubled mortgages.

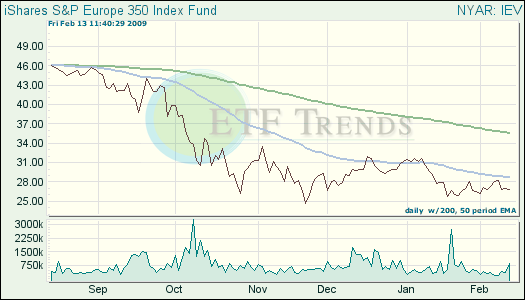

- iShares S&P Europe 350 (IEV): down 2.8% over three months; down 13.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.