- Colgate-Palmolive (CL), consumer staples; and PepsiCo (PEP), snacks, soft drinks. Both are components of PowerShares Dynamic Consumer Staples Fund (PSL) – Colgate is 2.6%; Pepsi is 2.4%

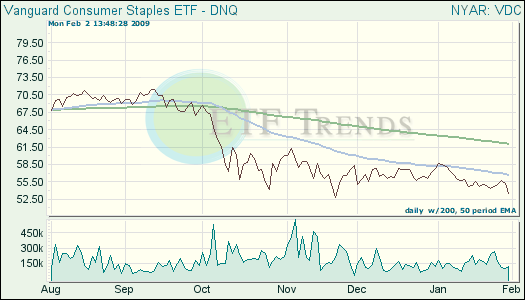

- Altria Group (MO), focuses on cigarettes, tobacco and Phillip Morris International (PM), cigarettes. Vanguard Consumer Staples (VDC) holds 3.2% of Altria; 14.8% of PM; 7.3% of Pepsi and 2.9% of Colgate.

These companies display sustainable earnings and have decent debt positions, two important factors to consider during a recession. Cash flow also is a big plus. And of course an exchange traded fund(ETF) is a better play because there is more diverisification and the risk is spread out over a basket of companies, rather then one.