As 2009 approaches many investors are considering where to put their money in the New Year, particularly with exchange traded funds (ETFs). Will the Middle East and Africa be a profitable place to put your money in the near future?

The real estate market may prove to be a decent place to park your money in the Middle East. According to Homesgofast, the top places for prospects of growth from international property investors are Dubai, Egypt and Tunisia. Some of this research is backed by internet traffic and inquiry trends form their own websites.

The top place is Dubai, where many blue chip companies have set up shop for tax purposes, and this trend will continue into 2009. Investors are aware of the increased demand for real estate in this region as a result.

The Red Sea area in Egypt is a popular spot for divers and offers low-cost property with high capital growth opportunity. Tunisia is the biggest surprise of all, and this region differs from the rest as infrastructure is in place and the flights are available to access this area. Foreigners are just now able to purchase property here as the government has ensured it remains affordable.

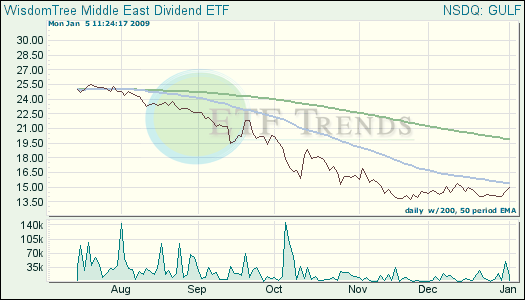

- WisdomTree Middle East Dividend Fund (GULF): down 23.3% for the last three months; Egypt 12.1%; United Arab Emirates 12.1%

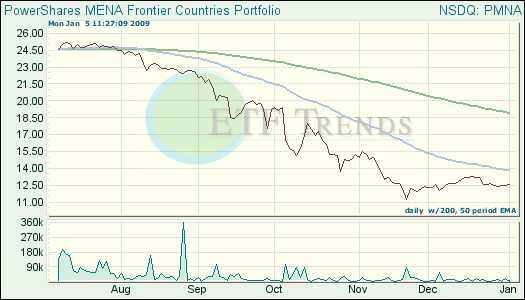

- PowerShares MENA Frontier Countries (PMNA): down 34.4% in the last three months; Egypt 14.5%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.