Advocates for global warming urge that the United Sates must break its dependency on oil and Congress must pass funding for a new energy bill. What effect will this have on exchange traded funds (ETFs) and exchange traded notes (ETNs) that track carbon?

Cap on Emissions. This new energy bill will focus on curbing carbon emissions, states Tom LoBianco for The Washington Times. In addition to President Barack Obama’s stimulus plan to double renewable energy, the United Nations is expected to meet in the coming weeks to discuss worldwide limits on carbon emissions.

World Is Melting. Research indicates that now is the time to make this transition. Ice is dissipating at an alarming rate, indicating that temperatures around the globe are on the rise. In 25 of the past 28 years, more ice has been lost than gained, with the last year of growth being reported in 1998, states Jeremy Van Loon of Bloomberg.

A Solution. If and when this bill passes, it will help the world alleviate the problem of the Earth being on fire by continuing to put a cap. Its always a good thing to be environmentally friendly, especially when thinking about future generations. Funds that track the price of carbon allowances are:

iPath Global Carbon ETN (GRN): down 24.4% over the last month

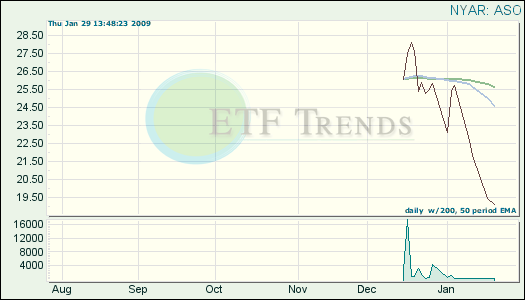

AirShares EU Carbon Allowances (ASO): down 26% over the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.