Timothy Geithner, nominee for Treasury secretary, is suggesting that he’d like a more confrontational stance with China. That raises the question of what the impact would be on our economy, China’s economy and their exchange traded funds (ETFs).

Currency Manipulation? Timothy F. Geithner, who was confirmed by the Senate on Thursday, told Senators that President Barack Obama believes that China was manipulating their currency, pointing at a much more defensive stance toward that country than the previous administration. Jackie Calmes for The New York Times reports the statement, which is certain to anger the Chinese government, comes at a particularly sensitive time, with economies in both the United States and China weakening and tensions already rising around the globe over trade.

The Risk. What’s more, the United States is dependent upon China more than ever as they could finance the growing deficit. Already, the country is losing its appetite for U.S. debt. The statement was supposedly remarked by the President, and signals were crossed as to whether this would be addressed in the spring, when the administration is required by a 20-year-old trade law to report to Congress on exchange rate issues.

Infrastructure Improvements. Meanwhile, China has begun extensive infrastructure projects, spending hundreds of billions of dollars to build highways, railroads and projects. This is their stimulus plan, which is intended to take the modern coastal developments of China and connect them to the innermost rural areas, an industrial revolution of sorts.

Keith Bradsher for The New York Times reports that China is already two months into their effort of a stimulus plan, while the United States is still in drafting mode of an $825 billion proposal. China is building up these efforts to take their country to a new level of global competition.

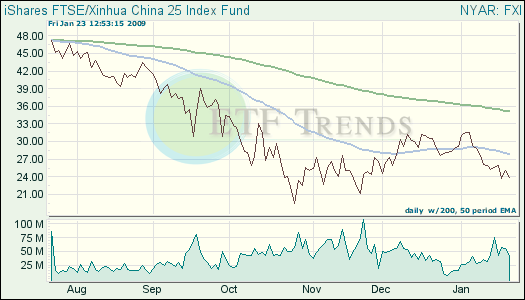

- iShares FTSE/Xinhua China 25 Index (FXI): up 0.5% over three months

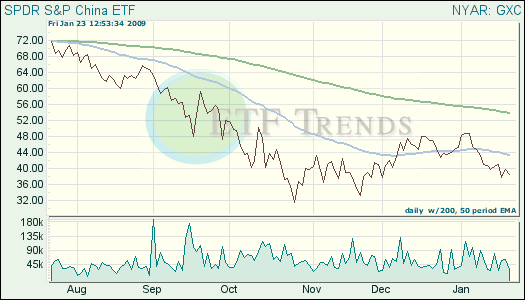

- SPDR S&P China (GXC): up 4.6% over past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.