A record sale of Treasury bonds could affect exchange traded funds (ETFs), especially now that yields are the highest they’ve been in two months. What does this mean for you?

The government’s $30 billion of five-year notes came with a 1.82% yield, which was higher than forecast. Bond yields and prices move opposite one another.

Low Yields=High Fear. When Treasury bond yields plummeted to record lows in recent months, it was a signal of rampant fear in the markets. There was a $40 billion two-year auction on Tuesday, as well, report Daniel Kruger and Anchalee Warrachate for Bloomberg. For investors interested in Treasuries, higher yields could make them more enticing.

The Fed Plan. The Federal Reserve is set to jump-start lending by purchasing longer-term Treasuries, if conditions persist, says Craig Torres for Bloomberg. It’s a shift for Chairman Ben Bernanke, who had been making rates the focus of policy. But now that rates are just about as low as they can go, the Fed has to consider other options. Bernanke also cautioned that inflation could fall too low, and deflation is an increased worry.

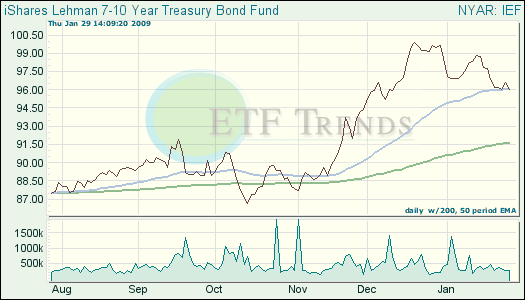

- iShares Lehman 7-10 Year Treasury Bond (IEF): down 3.3% in the last month; yield 3.7%

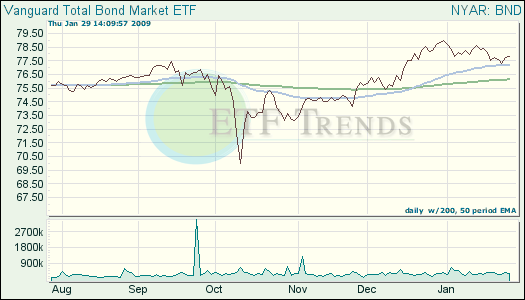

- Vanguard Total Bond Market ETF (BND): down 0.5% in the last month; 4.6% yield

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.